PILLAR 2: PROBLEM & SOLUTION SLIDES (2025 EDITION)

The inside-out, investor-first guide to crafting the two slides that make or break 70% of pitch decks.

1 — INTRODUCTION:

Why Problem & Solution Slides Are the “Decisive First Impression” in 2025**

If you watch any partner meeting inside a VC firm, you’ll notice something founders rarely understand:

Before a fund even cares about your market size, traction, financials, or product design…

they care about one thing:

👉 Is the problem big enough, painful enough, urgent enough — and real enough — to justify a venture-sized outcome?

Most founders make the same mistake here:

They think the Problem & Solution slides are “simple,” so they rush them.

But insiders will tell you:

70–80% of pitch decks die because the problem is vague, weak, unvalidated, or sounds like a founder hobby instead of a high-stakes pain point.

This happens because founders:

❌ describe symptoms instead of root problems

❌ exaggerate without evidence

❌ use generic corporate language

❌ confuse inconvenience with pain

❌ pitch “nice-to-have” ideas

❌ fail to connect problem → urgency → spend → decision-making

❌ talk about features instead of economics

❌ write vague “problem statements” like a school project

Meanwhile, top-tier decks (Scale, Benchmark, Sequoia, YC) do the opposite:

✔ They define a sharp, undeniable pain

✔ They show why the pain is expensive

✔ They reveal who feels this pain most

✔ They show why existing solutions fail

✔ They position their product as an inevitable fix

In 2025, this matters even more because:

Investors see 4,000+ decks/year, and most problems sound identical

AI-driven products make everything look like a “feature,” not a “company”

Investors are trained to detect exaggerated problem statements

VCs need problems that are big enough to justify funding

The solution must be simple enough to show clarity, but deep enough to signal insight

A strong Problem/Solution slide answers the only question that truly matters early:

👉 Why now? Why this? Why you? Why this problem? Why is this solution inevitable?

Get this right, and you will instantly move deeper into the VC funnel.

Get this wrong, and nothing else in your deck can save you.

🔗 Contextual links:

How pitch decks really work → /vc-pitch-deck-guide

AI Pitch Deck Analyzer tool → /ai-pitch-deck-analysis

2 — THE HIDDEN PSYCHOLOGY OF THE PROBLEM SLIDE

(What Investors Actually Look For — Not What Founders Think They Look For)**

Most founders believe the Problem slide is where they “explain what’s wrong in the world.”

Investors see it differently.

To a VC, the Problem slide is a risk filter.

It answers (or fails to answer) five silent questions in the first 5–8 seconds:

1. Is this a top-tier pain point or a “founder hobby”?

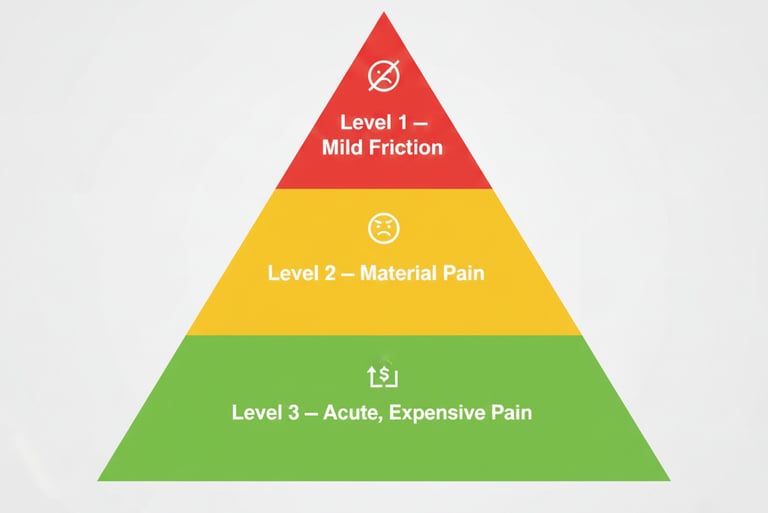

Investors instantly categorize your problem into one of three levels:

Level 1 — Mild Friction (Instant Pass)

An inconvenience. A workflow annoyance.

No urgency. No budget. No decision-maker pain.

→ These startups die at the analyst desk.

Level 2 — Material Pain (Conditional Interest)

The customer is annoyed enough to switch…

but not enough to rip out existing systems.

→ Needs a strong angle, differentiation, or niche.

Level 3 — Acute, Expensive, High-Stakes Pain (Green Light)

This is the gold standard.

It’s:

financially painful

operationally painful

emotionally painful

urgent

currently unsolved

growing

measurable

owned by a decision-maker with budget authority

Investors know this type of pain leads to:

✔ fast adoption

✔ budget justification

✔ repeatable sales

✔ strong retention

✔ enterprise contracts

✔ “VC scale revenue” over time

Founders who win funding always start with Level 3 pain.

2. Is the problem anchored in reality or imagination?

VC pattern recognition is brutal.

A problem slide dies when founders use:

❌ invented statistics

❌ vague statements (“People struggle with…”)

❌ aspirational language

❌ made-up personas

❌ unvalidated assumptions

Strong decks use:

✔ founder lived experience

✔ customer insights

✔ data from real conversations

✔ a “moment of insight” story

✔ actual economics (time wasted, revenue lost, costs incurred)

Investors want to see that your problem is not just theoretical, but validated.

3. Is the problem tied to a buyer who spends money?

This is where most decks fail.

Founders describe a pain…

but not a payer.

VCs ask:

👉 Who loses money because of this problem?

👉 Who wastes time?

👉 Who feels the pain in their KPIs?

👉 Who has budget?

👉 Who is desperate to fix it?

A problem without a payer is not a business.

A problem with a weak payer is not a venture-scale business.

4. Does the problem create urgency, or can customers delay?

VCs fund urgency, not “nice to haves.”

Founders must show:

switching cost is justified

delay is expensive

the problem compounds

the pain is accelerating

customers suffer consequences (lost revenue, churn, risk)

If the customer can delay, investors delay too.

5. Does the founder demonstrate insight, not just observation?

Observation: “Companies struggle with data fragmentation.”

Insight: “The real problem is every department creates shadow databases, leading to hidden operational debt.”

VCs invest in insight, because insight signals:

✔ founder–market fit

✔ depth of problem understanding

✔ ability to build something 10x better

✔ ability to outthink competitors

✔ strategic clarity

Investors care about insight even more than traction in early stages.

3 — HOW INVESTORS SCREEN PROBLEM & SOLUTION SLIDES (THE REAL FUNNEL)

What actually happens behind the scenes inside VC firms — and why most decks fail in the first 12 seconds.

Most founders believe investors read pitch decks “linearly,” like a school project.

In reality, every VC firm has a multi-layered filtering system, where Problem & Solution slides act as the first — and most decisive — filter.

The truth is brutally simple:

👉 If your Problem or Solution slide fails, nothing else in your deck will be seen.

Not your traction.

Not your TAM.

Not your team.

Not your vision.

This section breaks down the actual screening funnel that occurs inside VC firms — and how these two slides determine whether you survive the first 12 seconds.

THE 5-STAGE VC SCREENING FLOW FOR PROBLEM & SOLUTION

There are five distinct screening layers your deck passes through before a partner even hears your name.

Understanding these layers allows you to build slides that “pass the system,” not just “look nice.”

1. The Analyst/Associate Filter (0–12 seconds)

This is where most pitch decks die.

Analysts care about only three things at this stage:

Is the problem real and painful?

Is the solution credible and differentiated?

Does this look like something worth escalating?

Analysts are not incentivized to take risks.

Their job is not to champion founders — it is to avoid wasting partners’ time.

So they ask:

❌ Does the problem sound like a feature?

❌ Does the founder sound delusional?

❌ Does the solution sound commoditized?

❌ Is the problem small or vague?

❌ Is the solution too complex?

If the Problem & Solution slides fail any of these filters, the deck gets archived within seconds.

2. The Partner Pre-Screen (12–40 seconds)

If the analyst forwards your deck, a partner opens it.

Partners scan even faster.

They aren’t reading —

they are pattern matching.

Their brain runs a silent checklist:

Does this problem look like a venture-scale opportunity?

Does the solution sound like a wedge into a big market?

Does the founder understand the problem deeply?

Does the solution show technical or strategic leverage?

Does this resemble another successful company we've funded?

Partners think in bets, not details.

What matters to them in this stage:

Signal → Pattern → Potential

If they can't imagine this becoming a $500M–$1B outcome…

they won’t dig further.

3. The “Can This Become a Category?” Check (40–90 seconds)

This is the most misunderstood investor filter.

VCs do not fund solutions.

They fund:

✔ categories

✔ markets

✔ inevitable shifts

✔ emerging momentum

✔ irreversible behavior patterns

So the partner asks:

Does this problem → create a movement?

Does the solution → create a wedge that can expand?

Example:

Slack wasn’t a chat app.

It was a wedge into the “future of internal communication.”

Airbnb wasn’t room rentals.

It was a wedge into the “trust-based travel economy.”

Investors look for this exact leverage on your Solution slide.

4. Internal Discussion (2–5 minutes)

If a partner likes your deck, they might share it with:

1 co-partner

1 senior associate

or the whole investment committee

(depending on the firm)

Here’s the catch:

Everyone sees your Problem & Solution slide first.

And they judge it harshly.

They ask:

“Is this pain valuable enough?”

“Is the solution defensible?”

“Why hasn’t this been solved already?”

“Is this problem growing?”

“Does this solution scale?”

“Is this a feature or a company?”

If the room can’t agree on the Problem/Solution strength, the deal dies here — silently, without feedback.

5. The Narrative Compression Test (Final Gate)

This is one of the most unfair filters.

Partners internally reduce your deck to a 1–2 sentence pitch.

And it ALWAYS comes from your Problem & Solution slides.

Examples:

“They’re solving employee retention through automated skill mapping.”

“They fix broken medical billing with AI-first workflows.”

“They’re building a new sales channel for SMBs through micro-influencers.”

If your Problem/Solution slides do not produce a clear, crisp internal narrative, you will NEVER get a meeting.

VCs need to “sell you internally” — and these two slides are what they sell.

WHY THIS FUNNEL MATTERS

Because it proves something founders forget:

👉 Investors do not fund products.

They fund inevitability.

Your Problem slide → establishes inevitability.

Your Solution slide → justifies it.

If both fail, no traction number can save you.

If you want the shortcut:

Our Funding Blueprint Kit includes the exact Problem & Solution slide frameworks that consistently pass these 5 screening layers inside VC firms.

4 — THE ANATOMY OF A WINNING PROBLEM SLIDE (THE COMPONENTS THAT TURN A “STATEMENT” INTO A VENTURE-BACKABLE NARRATIVE)

Most founders write their Problem slide like a school assignment:

“People struggle with X.”

Or worse:

“The industry is broken.”

This is why 80%+ of Problem slides get flagged as generic, unconvincing, or non-venture-scale by analysts and partners.

A venture-ready Problem slide is not a statement — it is a strategic argument.

An argument that says:

1. This problem is real.

2. This problem is expensive.

3. This problem is urgent.

4. This problem is massively underserved.

5. This problem creates a wedge into a large market.

When your Problem slide does this well, your Solution slide becomes almost self-evident.

In this section, we break down the exact components top-tier founders use — including Sequoia-style phrasing, YC-style precision, and Benchmark-style insight density.

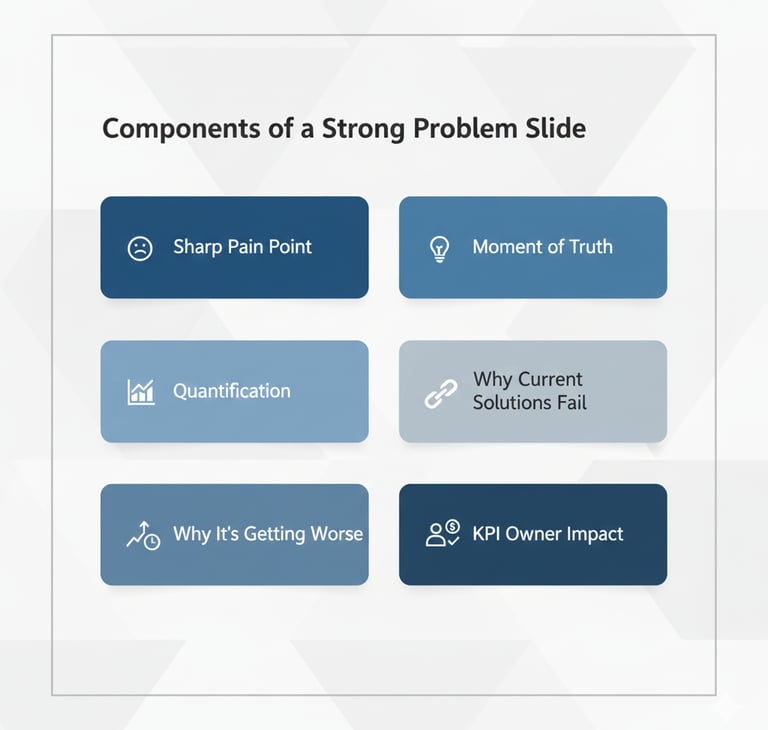

THE 6 COMPONENTS OF A HIGH-CONVERSION PROBLEM SLIDE

A strong Problem slide has six structural elements used (implicitly) by almost every top-funded startup.

Let’s break them down.

1. A Sharp, Specific Pain Point

Not a general observation. Not a vague complaint. A precise pain.

Investors should instantly understand:

Who feels the pain

When they feel it

What triggers it

How severe it is

What it costs them

Why it persists today

Bad example (generic):

“Remote teams struggle with communication.”

Good example (specific, investor-friendly):

“Fast-growing remote teams spend 30–40% more time resolving duplicate work because they lack real-time visibility across projects.”

Specificity = credibility.

2. A “Moment of Truth” Scenario

Investors love “zoomed-in, real-world” representations of the pain.

This is why YC asks founders:

“What’s the exact moment a customer realizes they need you?”

Example:

“When a CFO realizes financial close takes 8–12 days instead of 2–3, delaying board reporting and exposing operational risk.”

This takes the problem from abstract → undeniable.

3. Quantification of the Pain (Time or Money Lost)

VCs don’t invest in “annoyances.”

They invest in economic gravity.

You show gravity by quantifying:

hours wasted

revenue lost

customers churned

budgets misallocated

processes delayed

compliance risk incurred

extra headcount required

Investors LOVE numbers on the Problem slide because they make the solution sound like an inevitable business decision.

Example:

“Mid-market logistics teams lose $280k–$1.2M annually from routing inefficiencies.”

Numbers = urgency.

4. Why Current Solutions Fail (The Investor Red Flag Filter)

Investors ask this instantly:

👉 “If this problem is so painful, why hasn’t it been solved already?”

A strong Problem slide addresses:

outdated tools

fragmented workflows

manual processes

legacy systems

siloed data

lack of automation

expensive or complicated alternatives

Example:

“Existing compliance tools were built in the 2000s, rely on manual review, and collapse when teams exceed 200 employees.”

You show the gap that your Solution will fill.

5. Why the Problem Is Getting Worse (Trend Acceleration)

VCs invest in problems that grow, not ones that stay static.

Investors need to see macro force behind the pain:

AI adoption

hybrid work

fragmentation

regulatory changes

rising customer expectations

cost pressures

global workflows

data explosion

Example:

“AI-driven teams generate 10× more micro-decisions per week — making traditional approval chains collapse under volume.”

Trend → inevitability → funding.

6. Whose KPI Is Destroyed by This Problem? (The Budget Owner Signal)

This is one of the strongest but least-known elements.

Ask yourself:

Whose job performance is damaged because this problem exists?

If the answer is “nobody important,” the startup dies here.

Examples:

CFO → inaccurate forecasting

COO → operational delays

CMO → wasted ad spend

CTO → tech debt explosion

Head of Sales → lead leakage

HR → high churn

CISO → compliance exposure

If your Problem slide clearly targets a KPI that gets someone fired → investors lean in.

WHY THIS 6-PART STRUCTURE WORKS

Because it mirrors exactly how investors mentally process early-stage risk:

Pain clarity → reduces market uncertainty

Quantification → reduces revenue uncertainty

Trend acceleration → reduces timing uncertainty

KPI impact → reduces buyer uncertainty

Failure of existing solutions → increases defensibility

Moment of truth → creates emotional resonance

When all six are present, a partner can confidently say:

“This is a big, painful, urgent problem that will definitely get solved — and these founders understand it deeply.”

That is the sentence that gets you into a partner meeting.

🔗 Internal Links

Full deck frameworks available at → /vc-pitch-deck-guide

5 — THE MOST COMMON MISTAKES FOUNDERS MAKE ON PROBLEM SLIDES (AND HOW VCs SPOT THEM INSTANTLY)

Almost every weak pitch deck dies at the Problem slide — not because the problem is small, but because the founder presents it poorly.

Investors have developed hypersensitive pattern-recognition around this slide because it is the earliest predictor of:

clarity of thinking

founder–market fit

how deep the founder actually understands the space

and whether the solution has venture-scale potential

In this section, we’ll break down the most damaging mistakes, why they destroy trust instantly, and how you can fix them.

(You can also run your current slide through the AI Pitch Deck Analyzer → [link: /ai-pitch-deck-analysis] to see where you stand.)

Mistake #1 — Describing a “Frustration,” Not a “Pain”

Founders often describe annoyances:

“Teams find it hard to stay aligned.”

“People struggle to remember tasks.”

“SMBs find finance complicated.”

Investors instantly categorize these as non-budgeted, low-urgency, easy-to-ignore frustrations.

A frustration is irritating.

A pain is expensive.

The fix:

Frame the problem around lost money, lost efficiency, lost opportunity, or regulatory risk.

This is also where your Solution slide becomes twice as strong, because a painful problem naturally demands a compelling remedy. For frameworks that help shape this entire flow, see [link: /vc-pitch-deck-guide].

Mistake #2 — Being Too Vague, Too Broad, or Too Generic

The fastest way to lose a VC’s attention is to say something like:

“The healthcare industry is outdated.”

“SMBs lack marketing tools.”

“People want easier ways to manage money.”

This reads like ChatGPT — not like a founder with lived insight.

VCs hate generalizations because they:

hide lack of research

signal founder naivety

don’t identify a buyer

don’t show an insight advantage

Instead, show specificity, like:

“Clinic managers spend 12–18 hours a week reconciling patient claims manually because their legacy RCM system can’t process EDI exceptions.”

Specificity = credibility.

Mistake #3 — Describing the Problem From the Founder’s POV Instead of the Customer’s POV

Founders say:

“We believe the hiring process is broken.”

“We think supply chain tools are outdated.”

Investors want to see the customer’s belief, not yours.

VCs always ask:

👉 “Whose KPIs are being damaged?”

👉 “Whose day is being ruined?”

👉 “Who is emotionally and economically affected?”

Tired of making founder assumptions that fall flat? The reason our homepage kit consistently outperforms a costly $5K consultant is simple: it completely rewrites your pitch deck to align with the proven mental models of venture capitalists. Stop guessing what VCs want and start speaking their language instantly.

Mistake #4 — No Evidence, No Data, No Validation

Weak decks rely on generic statements like:

“The market is huge.”

“There is a massive need.”

“People struggle with this every day.”

Strong decks use validation:

50+ customer interviews

data points

early usage behavior

time lost

dollars wasted

churn problems

workflow bottlenecks

operational risk

VCs trust evidence-backed narrative 10× more than founder opinions.

Mistake #5 — No Clear Buyer / No Budget Owner

Many decks describe a real problem…

but with no one who would ever pay to fix it.

Founders often overlook:

procurement influence

budget-holding roles

internal politics

switching cost justification

priority scoring inside companies

A problem without a payer = not a business.

A problem with a weak payer = not venture-scale.

This is one of the top reasons decks fail in the first 12 seconds.

Mistake #6 — Over-Explaining the Problem (Trying to “Sell” the Pain)

If you need four paragraphs to explain what the problem is, investors assume:

The market doesn’t feel the pain strongly, or

You aren’t close enough to the customer to state the pain crisply.

Great Problem slides are short, sharp, and painful.

One line + two bullets + one micro-statistic = ideal.

Mistake #7 — Talking About Trends Instead of Pain

Founders sometimes confuse trends with problems:

“AI is growing fast.”

“E-commerce is booming.”

“Healthcare is shifting remote.”

These are context, not pain.

Trends don’t get customers to pay.

Pain does.

A trend only matters when it exacerbates a pain:

“E-commerce is growing 18% YoY — making product returns increase 2.4× faster, overwhelming warehouse capacity.”

Pain + trend = investor attention.

WHY VCs SPOT THESE MISTAKES INSTANTLY

Because they’ve seen thousands of decks.

Every mistake above signals one of three red flags:

This founder doesn’t deeply understand the problem.

This problem is not urgent enough to justify budget.

This startup will struggle to scale or differentiate later.

When investors see even one of these patterns, the deck ends up in the “no” pile — fast.

6 — THE ANATOMY OF A WINNING SOLUTION SLIDE

(How to Show Clear, Elegant, Inevitable Value Without Overselling)

If the Problem slide answers:

👉 “Why does this pain matter?”

Then the Solution slide must answer:

👉 “Why is your solution the inevitable fix?”

Here’s what most founders get wrong:

They treat the Solution slide like a feature list, instead of:

a strategic wedge into a large market

a proof of unique insight

a demonstration of clarity

a rationale for why THIS team should win

the simplest articulation of value that works at scale

Your Solution slide is not a tour of your product.

It is your company’s thesis — compressed into a single page.

Just like your Problem slide reveals how deeply you understand the pain, the Solution slide reveals how deeply you understand the industry mechanics.

This is why most bad decks fail even when the startup is good.

You either show:

✔ clarity

✔ elegance

✔ inevitability

—or you get flagged as:

❌ too complex

❌ too technical

❌ no wedge

❌ no defensibility

❌ a feature, not a company

This section teaches you the exact structure VCs subconsciously grade you against.

THE 5 ELEMENTS OF A HIGH-CONVICTION SOLUTION SLIDE

Strong Solution slides share five components.

Weak ones typically miss 3–4 of these.

Let’s break down each with examples VCs expect.

1. The Crisp One-Sentence Value Proposition

This sentence MUST:

be short

be outcome-driven

be clear to a non-technical investor

be written like a Sequoia headline

show immediate relevance to your Problem slide

Weak example (feature-focused):

“An AI-powered analytics dashboard for logistics teams.”

Strong example (outcome-focused):

“We cut routing errors by 80% for logistics teams using a real-time AI decision engine.”

Outcome > Feature.

Clarity > Complexity.

This is EXACTLY the style used in the templates inside our Funding Blueprint Kit, because VCs strongly prefer solution statements that are easy to repeat internally.

2. The “How It Works” Flow (In 3–5 Simple Steps)

Investors don’t want technical depth here — just clarity of mechanics.

Use a simple flow:

Trigger

Input

Processing

Output

Result

Example:

“Teams upload invoices.”

“AI categorizes and validates line items.”

“Errors are flagged automatically.”

“Payments sync with ERP.”

“Finance closes 3× faster.”

This communicates:

✔ the system works

✔ the founder understands the workflow

✔ the product is not magic, but logic

✔ the buyer can easily imagine adoption

This “flow-clarity” is EXACTLY what partners look for when doing quick pattern-matching.

If they can’t explain your solution internally, your deal dies.

You can see similar examples in the deep dive → link: /vc-pitch-deck-guide

3. The “Why Existing Solutions Fail” Contrast

VCs don’t care that your solution is “better.”

They care that it is inevitable.

To prove inevitability, contrast:

legacy systems

manual processes

fragmented workflows

spreadsheet hacks

expensive alternatives

slow operations

incomplete tools

Example phrasing (very investor-friendly):

“Current solutions were built for a pre-AI world. They require manual setup, break at scale, and provide no real-time corrective actions.”

This line alone demonstrates:

insight

founder–market fit

future-proof positioning

Strong decks often position the Solution slide as a natural evolution, not a competitor.

4. Proof of Leverage (Your Strategic Advantage)

VCs always ask:

👉 “Why will this team win?”

Your Solution slide must reveal at least one structural advantage:

proprietary data

unique workflow insight

automation edge

operating model advantage

network effect

viral loop

switching cost

speed of execution

category creation angle

This is “the wedge.”

Without a wedge, investors categorize you as “a feature someone else can copy.”

For example:

“Our AI model is trained on 4.2M logistics exception records collected through 7 years of consulting work.”

Proprietary, not generic.

5. The Clear, Quantifiable Outcome

VCs do not invest in “solutions.”

They invest in outcomes.

Examples:

“Cut churn by 34%.”

“Reduce invoice processing time from 9 days to 36 hours.”

“Increase GMV per seller by 22%.”

“Automate 72% of repetitive compliance tasks.”

When you quantify the outcome, you:

✔ make your impact undeniable

✔ show customer ROI

✔ strengthen the financial narrative

✔ reduce investor risk perception

✔ prove founder-depth

A good rule:

Your Solution slide must show 1 hard number, even if you are pre-launch.

If pre-product, quantify potential, e.g.:

“Teams waste 12 hours/week on manual triage — even automating 25% saves $900/month per manager.”

VCs don’t need final data; they need logical economic gravity.

WHY THIS STRUCTURE WORKS

Because it aligns perfectly with how investors think:

1 sentence → internal pitch-ready summary

flow → comprehension

contrast → inevitability

wedge → defensibility

outcome → economic logic

This is why strong Solution slides feel clean, calm, and obvious — even if the underlying product is complex.

Investors reward clarity because clarity signals competence.

7 — THE SILENT RED FLAGS VCs LOOK FOR IN SOLUTION SLIDES

(And Why Most Founders Don’t Realize They’re Making These Mistakes)

Founders often believe that the Solution slide is the “easy” one — the fun slide where they showcase the product, screens, features, and vision.

But to investors, the Solution slide is not about features.

It’s about founder clarity, strategic positioning, and venture-scale potential.

During a partner meeting, the Solution slide is scanned for red flags, not beauty.

And here’s the truth most founders don’t know:

👉 VCs reject more decks because of Solution slide red flags

than any other slide besides financials.

In this section, we break down the EXACT red flags investors look for — the ones they won’t tell you, the ones they rarely write in feedback emails, and the ones that instantly move your deck from “maybe” to “no.”

RED FLAG #1 — The Solution Is a “Feature,” Not a “Company”

This is the most fatal mistake.

If your slide reads like:

a new AI feature

a workflow automation

a plugin

a chrome extension

a niche improvement

a small convenience

or something easily added by an incumbent

VCs immediately categorize it as non-defensible.

Investors think in categories, not products.

A solution must signal:

✔ ecosystem value

✔ platform potential

✔ compounding advantages

✔ scalability

✔ category creation

This is where a deep deck structure helps.

RED FLAG #2 — Too Much Complexity (Investors Can’t Explain It Internally)

A complicated Solution slide kills momentum.

If a partner can’t explain your solution in a 10-second internal summary, they cannot champion you.

Internal advocacy is EVERYTHING in VC.

When you force partners to “decode” your slide:

you add friction

you create confusion

you make the deal harder to sell internally

you increase perceived execution risk

A Solution slide should be simple enough that an analyst could summarize it confidently.

If not, your deal almost always dies in partner pre-screening.

This is why clear structure matters.

RED FLAG #3 — Solutions Based Only on AI or Automation (Without a Hard Wedge)

In 2023–2025, AI is everywhere.

Meaning:

If your solution is only:

“We use LLMs to automate X”

“AI predicts Y”

“AI generates Z”

—then investors mark you as a feature startup, not a venture-scale company.

VCs want a wedge, not a buzzword.

They specifically look for:

proprietary data

workflow depth insight

an underserved persona

structural advantages

switching cost

network or ecosystem lock-in

defensible distribution

cross-functional value chain entry

Using AI is not impressive anymore.

Using AI strategically is.

RED FLAG #4 — The Problem & Solution Don’t Map Perfectly

Investors expect a 1:1 narrative alignment:

Big problem → big solution

Pain point → feature set

KPI hit → outcome improvement

Current bottleneck → exact workflow fix

If your solution looks disconnected from your problem, VCs assume:

the founder is improvising

the deck is mismatched

the product doesn’t actually address the pain

the founder is inexperienced

the pitch is narrative-first, not customer-first

A mismatch between these two slides is one of the top reasons investors immediately lose confidence.

RED FLAG #5 — The Solution Looks Hard to Implement or Hard to Adopt

This is subtle but deadly.

If your solution:

requires behavior change

requires customers to rip out existing systems

replaces too many workflows at once

requires data migration

requires long setup

replaces multiple departments at the same time

feels “heavy” or “uphill”

—investors instantly see churn, not growth.

Founders tend to showcase ambitious features.

Investors prefer a clean, realistic wedge.

They want:

✔ fast adoption

✔ minimal switching friction

✔ immediate value

✔ workflow continuity

✔ low resistance

RED FLAG #6 — No Hint of Defensibility

If your Solution slide does NOT imply:

a data advantage

a workflow advantage

a distribution edge

a market insight edge

compounding network effects

switching cost

operational leverage

—you will be categorized as a non-defensible startup.

This is especially fatal in saturated markets (AI tools, analytics, SMB SaaS, HR tech, martech, etc.).

VCs don’t need proof of defensibility at seed.

But they DO need the hint of it.

Your Solution slide must show an inevitable edge, even if subtle.

WHY THESE RED FLAGS MATTER SO MUCH

Because your Solution slide is not just about what you built —

it’s about:

✔ how you think

✔ how you execute

✔ how you scale

✔ how you enter a category

✔ how you defend your position

✔ how you build momentum

Founders who eliminate these red flags automatically look mature, credible, and investor-ready — regardless of stage.

And that’s exactly why the strongest founders use frameworks:

Clarity always beats complexity.

If you want to eliminate every single Solution slide red flag automatically, our Funding Blueprint Kit:- VC PITCH DECK includes the entire system:

Replace Your $5K Pitch Deck Consultant With One System

Used by founders who’ve collectively raised $40M+.

A VC-Ready Pitch Deck, Sales Deck & AI Financial System.

8 — THE PERFECT PROBLEM → SOLUTION TRANSITION

(The Seamless Narrative Bridge That Makes Investors Lean In)

Most founders underestimate the transitional moment between the Problem slide and the Solution slide.

But insiders will tell you:

👉 This transition is where investors decide if your deck “has a shot” or not.

Because the transition between these two slides reveals:

how clearly you think

how well you understand the problem

whether the solution is a natural evolution

whether the narrative flows logically

whether the founder is forcing a product onto a weak pain

or revealing an inevitable product built around a deep pain

A perfect transition feels like this:

“Of course. That makes complete sense.”

A weak transition feels like this:

“Wait… what? How did we get from Problem to Solution?”

And when investors feel that disconnect, the entire deck loses conviction instantly.

This is why the transition between these slides is the MOST IMPORTANT narrative hinge in your entire pitch.

In this section, we dissect the mechanics of a powerful Problem → Solution transition — the exact one used by unicorn founders, YC top performers, and Sequoia-backed teams.

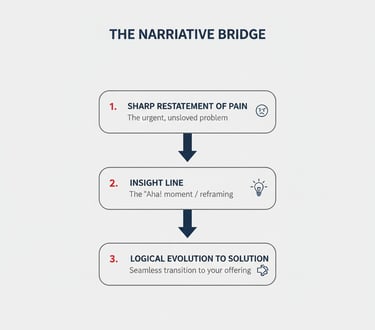

THE 3 ELEMENTS OF A SEAMLESS PROBLEM → SOLUTION TRANSITION

There are three narrative elements that create an “inevitable” feeling:

1️⃣ Restatement of the Pain (Sharper, Not Longer)

2️⃣ Emergence of Insight (Why the Pain Exists)

3️⃣ Logical Evolution to the Solution (Why This → That)

Let’s walk through them.

1. The Sharp Restatement (The “Snap Focus” Line)

You do NOT repeat the entire Problem slide.

You extract the sharpest insight — the one that sets up the solution perfectly.

Examples:

“The real pain is not lack of visibility — it’s the fragmentation of decision-making across teams.”

“The true bottleneck isn’t the workflow — it’s the manual triage in the middle.”

“The core issue isn’t compliance — it’s the reactive review loop built into legacy systems.”

This sharp restatement acts as a bridge hook, re-engaging the investor’s brain before the transition.

You can see many of these patterns inside the structured templates → [link: /vc-pitch-deck-guide].

2. The “Insight Line” (The Founder’s Deep Understanding Moment)

This is the most powerful—but most missing—line in pitch decks.

This line answers:

👉 Why does this problem REALLY exist?

Example:

“This pain persists because every team has created its own shadow database, making cross-functional sync impossible.”

Or:

“This problem exists because current tools were built for low-volume, predictable workflows — not the dynamic, AI-driven operations of 2025.”

This line is why investors believe:

you understand the market

you have founder–market fit

you have insight depth

you see what others don’t

your solution will be differentiated

Founders who skip this line appear shallow.

Founders who nail it appear inevitable.

3. The Logical Evolution Line (The “Therefore…” Moment)

This is where the investor’s brain subconsciously says:

👉 “Yes, that solution makes complete sense.”

This line must:

be short

be logical

feel like a natural evolution

tie directly to the root pain

connect economics + workflow

show inevitability

Example:

“Therefore, the only solution is a real-time, cross-functional decision engine that centralizes workflows and eliminates shadow databases.”

Or:

“Therefore, solving this requires a single AI-first triage layer that sits across systems and automates decisions at scale.”

This connects the pain → to the only viable fix.

When done well, the Solution slide becomes anticipated.

THE INVESTOR PSYCHOLOGY BEHIND THIS TRANSITION

This transition is powerful because it aligns with how the brain processes narrative:

• Clarity → reduces cognitive load

• Insight → increases founder credibility

• Logical evolution → reduces perceived risk

• Anticipation → makes the solution feel inevitable

• Flow → increases trust

• Pattern-matching → accelerates internal buy-in

Investors lean forward when they feel a narrative is tight, clean, and inevitable.

This is why the strongest decks use this 3-step transition — because investors have no mental resistance to the shift.

9 — HOW TO CRAFT THE PROBLEM SLIDE WHEN YOU’RE PRE-PRODUCT OR PRE-TRACTION

(The Insider Strategy to Win Funding Without Metrics)**

Most early founders panic at this stage:

“How do I explain the problem if I don’t have users?”

“What if I don’t have traction or metrics yet?”

“Will investors even take me seriously without numbers?”

Insiders know the truth:

👉 Pre-product founders are judged MORE on the Problem slide than on traction.

👉 Pre-traction founders can STILL raise — if the Problem slide is crafted correctly.

👉 VCs expect deep insight, not metrics, at the earliest stages.

Some of the biggest rounds in Silicon Valley history were raised before the product existed:

Figma

Notion

Rippling

Linear

Deel

Superhuman

Ramp

Scale AI

Anduril

All raised early, and NONE of them had meaningful traction at the beginning.

What they DID have:

✔ powerful Problem slides

✔ world-class founder insight

✔ sharp articulation of pain

✔ compelling narratives

✔ inevitability

✔ thesis-led framing

✔ proof of depth

✔ evidence they lived the problem

So in this section, we break down exactly how to craft a high-conviction Problem slide when you have no product and no traction.

THE 5 ELEMENTS OF A PRE-PRODUCT PROBLEM SLIDE THAT STILL WINS FUNDING

Pre-product Problem slides follow a different structure than normal decks.

They focus more on insight and customer understanding than on data.

Here’s the structure top accelerators use.

1. Use the “Founder Insight Line” to Establish Credibility (Your Origin of Insight)

When you’re pre-product, you can’t show:

usage data

retention

revenue

churn

traction charts

So you must show insight instead.

You need one powerful, conversational, investor-friendly sentence explaining where your insight came from.

Examples:

“I ran operations at three logistics companies and saw this bottleneck destroy efficiency every single quarter.”

“I built internal analytics tools at Stripe and realized every growth team struggles with the same data fragmentation problem.”

“As a clinician, I saw firsthand how manual triage delays care for thousands of patients daily.”

2. Quantify the Pain Using Industry Data (Not Your Own Metrics)

You don’t have traction, but the industry does.

Use:

✔ industry reports

✔ analyst data

✔ operational benchmarks

✔ competitor data

✔ economic impact studies

✔ regulatory pressure

✔ time-motion studies

✔ workflow research

Example (pre-product friendly):

“Mid-market warehouse teams lose an estimated $280k–$1.2M annually due to misrouted shipments, based on industry averages from 120+ logistics firms.”

VCs don’t expect your data.

They expect strong contextual evidence.

3. Use Customer Interviews as Proxy Validation

Even 10–15 conversations create powerful narrative signals.

Founders often underestimate how convincing this sounds to investors:

“We interviewed 42 clinic managers — 38 said claims exceptions are their #1 operational bottleneck.”

“After 65 conversations with e-commerce operators, 71% said vendor coordination breaks during peak weeks.”

Even pre-product.

Even pre-MVP.

Even pre-traction.

Interview data shows:

✔ curiosity

✔ discipline

✔ customer obsession

✔ depth of understanding

✔ early pattern recognition

This is gold for VCs at pre-seed.

4. Create a “Day in the Life” Insight (VCs LOVE this)

This is one of the strongest but least-used tactics.

Describe a moment when the user feels the pain clearly:

“A warehouse manager starts their Monday with 170 pending exception tickets — each requiring manual validation across 3 different systems.”

Or:

“A growth lead spends 6–9 hours weekly consolidating data from 11 tools just to understand what happened last week.”

This is where investors relate emotionally to the pain.

The strongest pre-product decks emotionally recreate the problem.

5. Show Why the Pain Is Accelerating (Not Just Existing)

This is critical because:

👉 VCs don’t fund static problems — only accelerating ones.

Make sure your slide shows a trend that magnifies the pain:

AI adoption

hybrid work

increased regulation

rising customer expectations

data explosion

workflow fragmentation

macro shifts

cost pressures

Example:

“AI-driven teams now create 10× more micro-decisions per week — overwhelming traditional review loops.”

This gives investors justification for why NOW is the moment to fund your company.

You can pull this into your transition line from Section 8 for an even stronger narrative bridge.

WHY THIS PRE-PRODUCT PROBLEM FRAMEWORK WORKS

Because at pre-seed, investors are not buying:

❌ product

❌ metrics

❌ revenue

❌ traction

They’re buying:

✔ your brain

✔ your insight

✔ your clarity

✔ your narrative

✔ your strategic depth

✔ your understanding of the market

✔ your founder-market fit

This framework maximizes those signals.

This is why so many pre-product founders who follow this structure get funded — it aligns perfectly with what investors actually want to see.

10 — HOW TO WRITE THE SOLUTION SLIDE WHEN YOUR PRODUCT IS NOT BUILT YET

(The Art of Elegant Pre-Product Storytelling That Still Wins Funding)

If you’re pre-product or pre-MVP, this is one of the most stressful questions you face:

“How do I show a Solution slide when I haven’t built the solution?”

Here’s the truth from inside VC rooms:

👉 Pre-product founders are NOT judged on the product.

They are judged on the clarity of their thinking.

In fact, investors PREFER pre-product founders who show:

✔ strong insight

✔ clean articulation

✔ high clarity

✔ strong wedge logic

✔ realistic workflow

✔ defensible direction

✔ sign of founder–market fit

The Solution slide is NOT about features or UI.

It is NOT about showing screens, prototypes, or mockups.

It is about:

→ How clearly your brain can imagine an inevitable solution.

Investors are buying your clarity — not your code.

This is why founders without a product often get funded FASTER than founders with a messy MVP.

In this section, we break down EXACTLY how to create a high-quality Solution slide before anything is built.

You can run your draft through your analyzer for validation → link: /ai-pitch-deck-analysis

THE 5 FOUNDATIONS OF A PRE-PRODUCT SOLUTION SLIDE (USED BY TOP FUNDED FOUNDERS)

Each part builds credibility, logic, and inevitability.

1. Describe the Desired Outcome, Not the Product

Pre-product founders fail when they try to describe the thing.

Investors don’t care about the thing.

They care about the outcome.

Weak:

“An AI dashboard for operations teams.”

Strong:

“We eliminate 80% of manual triage by automatically resolving repetitive operational decisions.”

Notice:

✔ Outcome

✔ Clarity

✔ KPI impact

✔ Pain relief

✔ Zero features

A pre-product solution should feel like a promise, not a prototype.

Great founders write outcomes as if they’ve already seen the future — because they understand the workflow deeply.

2. Use the “Invisible MVP Framework” (3–5 steps)

When there is no product, give investors a simple logic flow.

VCs want to see the architecture of your thinking.

Use the “Invisible MVP Flow”:

Input

Processing

Output

Result

Impact

Example:

“Managers upload raw claims data.”

“The system auto-classifies exceptions based on historical patterns.”

“High-risk tickets are escalated automatically.”

“Low-risk tickets are resolved instantly.”

“Claims cycle time drops from 14 days to 3 days.”

This communicates:

✔ you fully understand the workflow

✔ you understand user triggers

✔ you know what creates ROI

✔ you are not hand-waving the product

You don’t need a UI.

You need logic.

3. Show the “Wedge First” (Then the Expansion Story)

The BIGGEST fear investors have at pre-product stage:

“What if this becomes a small feature?”

Your Solution slide must show:

➝ A wedge

➝ An expansion path

➝ A category potential

Example:

“We start with automated exception triage (the wedge).

Over time, we expand into full intelligent workflow orchestration (the platform).”

This is EXACTLY the strategy used by:

Slack

Notion

Linear

Figma

Rippling

A wedge → proves value fast

A platform → creates venture-scale upside

4. Borrow Workflow, Borrow Trust (The “Borrowed Furniture” Technique)

This is a professional storytelling tactic almost no founder knows.

If you are pre-product, you can use borrowed workflow elements:

industry standards

familiar processes

known bottlenecks

analogies from existing systems

improved versions of known steps

This does two things:

✔ reduces investor cognitive load

✔ increases perceived feasibility

Example:

“We integrate into the existing approval loop — but replace the manual triage center with an AI-first routing engine.”

Investors think:

“Ah — this fits into a system I already understand.”

This reduces perceived risk massively.

5. Show How the Solution Creates Compounding Value (Even If You Don’t Have Data Yet)

This is where the magic happens.

VCs don’t need your product to exist — they need the flywheel to exist.

Examples:

“Every processed workflow improves the model.”

“Every new user increases cross-team visibility.”

“Every transaction creates new data advantages.”

“Every connection increases distribution power.”

This shows inevitability, even pre-product.

VCs LOVE compounding logic — because compounding means market power.

THE PSYCHOLOGY OF WHY THIS WORKS

Because investors fund:

✔ insight

✔ clarity

✔ wedge logic

✔ category potential

✔ reasoning

✔ pattern-matching

✔ strategic thinking

—and NOT the code.

The strongest pre-product founders look like category architects, not product builders.

When you articulate your Solution slide with this structure, you signal:

I know the workflow

I know the buyer

I know the pain

I know the wedge

I know the expansion

I know the economics

I know where this becomes a billion-dollar company

This is EXACTLY what early-stage investors want.

11 — HOW TO PAIR YOUR PROBLEM & SOLUTION SLIDES WITH REAL-WORLD USE CASES

(The “Applied Clarity” Method That Makes Your Deck 10× More Convincing)

Most founders get the Problem slide right…

Some get the Solution slide right…

But very few go one step further — the step that triggers investor conviction:

👉 Pairing Problem + Solution with a real-world use case that proves the idea works in practice.

This is where the investor’s brain shifts from:

“Interesting.”

to

“I can SEE this working.”

A sharp use case transforms your pitch from theoretical → operational.

Founders often overlook this because they think a use case requires:

❌ a finished product

❌ real customers

❌ production-level workflows

Not true.

The best pre-seed and seed decks use hypothetical, but realistic use cases that demonstrate:

founder-depth

workflow mastery

clarity of logic

how the product actually helps

credibility

inevitability

Investors LOVE use cases because:

✔ they reduce abstraction

✔ they increase emotional resonance

✔ they reveal founder understanding

✔ they show where the solution “lives” in a real day

✔ they map directly to ROI

This is exactly why Sequoia, YC, and Benchmark push founders to include a use case early in the deck.

Let’s break down the exact structure.

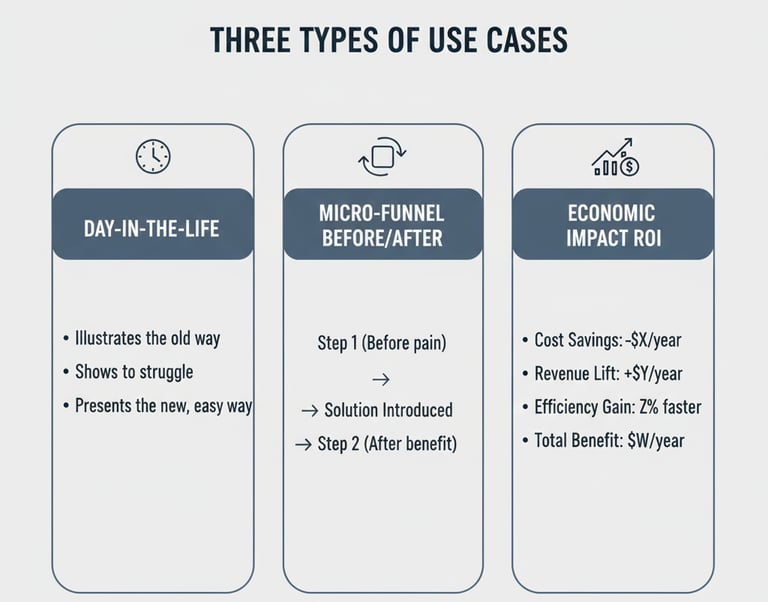

THE 3 TYPES OF USE CASES THAT MAKE INVESTORS PAY ATTENTION

Use cases come in three forms — you only need ONE to dramatically strengthen your Problem+Solution pairing.

Type 1 — The “Day in the Life” Use Case

(VC favorite for B2B, operations, productivity, and workflow startups)**

This use case answers:

👉 What does this solution look like inside a real user’s workflow?

Example:

Before:

“A clinic manager starts her morning with 140 claims exceptions, manually reviewing each across three systems.”

After:

“Exceptions are automatically classified. High-risk cases get escalated instantly. Low-risk ones are resolved without human review.”

This is powerful because it:

✔ mirrors real pain

✔ fits into a real job

✔ shows real process improvement

✔ brings your Problem slide to life

✔ reinforces the Solution slide

✔ creates emotional resonance

This structure fits perfectly with the narrative frameworks from earlier sections → [link: /vc-pitch-deck-guide].

Type 2 — The “Micro-Funnel” Use Case

(Great for AI tools, marketplaces, SaaS automation, etc.)**

This is a mini before/after funnel:

Before:

→ user must complete 8 steps manually

→ friction is high

→ error rate is high

→ ROI is unclear

After:

→ 2 steps

→ automated

→ predictable

→ ROI is explicit

Example for logistics:

Before:

Ticket created

Manager reviews

Data reconciled

Exception classified

System updated

Escalation

Communication

Approval decision

After:

AI classifies & resolves low-risk cases

Manager handles only high-risk exceptions

This is a clarity bomb for investors.

VCs IMMEDIATELY understand:

✔ value

✔ workflow

✔ feasibility

✔ ROI

✔ defensibility

Animate this in your pitch, and your deck feels 10× stronger.

Type 3 — The “Economic Impact” Use Case

(Perfect for fintech, ops tech, HR tech, supply chain, compliance)**

This is an ROI-focused miniature narrative:

Example:

“A mid-market logistics team processing 1,200 weekly tickets spends ~$24k/month in manual triage cost.

Our system automates 72% of low-risk cases → saving $17k/month.”

VCs love this because:

✔ they understand the business case

✔ it ties directly to KPIs

✔ it creates logical inevitability

✔ shows buyer motivation

✔ proves budget justification

You can validate your economic logic using the analyzer → [link: /ai-pitch-deck-analysis].

HOW TO PLACE THE USE CASE IN YOUR DECK (THE 2 BEST LOCATIONS)

There are two ideal placements:

Option A — Immediately After the Solution Slide (Recommended)

This makes your deck flow:

Problem → Solution → Real-World Use Case

This is the strongest narrative order because it:

✔ removes skepticism

✔ reinforces the solution

✔ activates investor imagination

✔ reduces cognitive load

Option B — Inside the Solution Slide (If space allows)

This works if you have a short Solution slide and want a tight storyline.

THE “USE CASE SENTENCE” — A CRITICAL ELEMENT

Every deck needs one sentence summarizing the use case:

“We reduce a 14-step manual workflow into a two-step automated review for logistics managers.”

This single sentence becomes the anchor investors repeat internally.

This is critical because your deck is not evaluated in isolation —

it is evaluated through internal conversations.

WHY USE CASES ARE SO PERSUASIVE TO INVESTORS

Because they activate BOTH sides of an investor’s brain:

Analytical Brain:

✔ ROI

✔ steps

✔ economics

✔ workflow

✔ logic

Emotional Brain:

✔ the frustration

✔ the relief

✔ empathy with the user

✔ narrative cohesion

When both are activated, investors feel:

“I get this. I like this. This could work.”

This moment is what moves you into partner meetings.

And this is why the strongest founders ALWAYS use use cases.

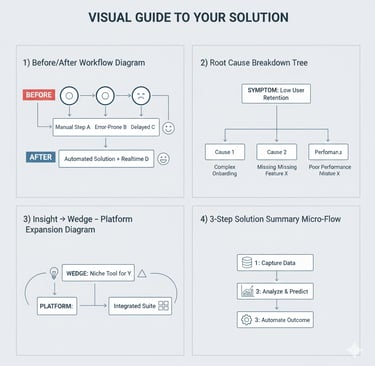

12 — HOW TO USE VISUALS, DIAGRAMS & MICRO-FLOWS TO STRENGTHEN YOUR PROBLEM & SOLUTION SLIDES

(The Visual Strategy That Makes Your Deck Instantly “VC-Ready”)

Here’s the truth few founders understand:

👉 VCs don’t actually “read” pitch decks — they scan visuals faster than they process text.

This is why:

✔ Good visuals → increase clarity

✔ Good visuals → reduce cognitive load

✔ Good visuals → make the narrative memorable

✔ Good visuals → help partners pitch you internally

✔ Good visuals → elevate your perceived sophistication

And the opposite is also true:

✘ Bad visuals make your deck look amateur

✘ Cluttered visuals confuse your story

✘ Overly-designed visuals distract from the point

✘ Generic icons = instant “this feels AI-generated” reaction

A strong visual strategy makes your Problem & Solution slides feel:

clean

high-trust

founder-intelligent

crisp

venture-grade

This is why Sequoia, YC, and a16z-backed founders overwhelmingly rely on minimal, well-crafted diagrams — not screenshots.

In this section, you will learn the exact visuals that strengthen this pillar of your deck.

THE 4 TYPES OF VISUALS THAT MAKE PROBLEM & SOLUTION SLIDES 10× STRONGER

These are visuals investors LOVE (because they make your thinking obvious).

1. The “Before → After Workflow” Diagram

(Best for: B2B, SaaS, operations, automation, fintech, logistics)**

This is the single most powerful visual for a Solution slide.

Before:

Cluttered, multi-step, manual workflow.

After:

Clean, minimal, automated flow.

Example flow:

Before:

Manual triage

Review

Classification

Corrections

Escalation

Update

After:

→ Automated classification

→ Only high-risk cases require review

This visual immediately communicates:

✔ clarity

✔ efficiency

✔ ROI

✔ feasibility

✔ value

You can build this using simple shapes — no design background required.

2. The “Root Cause Breakdown” Diagram

(Best for: Problem slide clarity)**

This visual shows:

surface problem

underlying causes

economic impact

workflow friction

why current tools fail

Example structure:

Main Problem

↳ Cause 1

↳ Cause 2

↳ Cause 3

Example for healthcare:

Slow claims resolution

↳ manual exception handling

↳ siloed data

↳ outdated systems

VCs LOVE this because:

✔ It clarifies insight

✔ It shows depth

✔ It proves you understand the workflow

✔ It reduces ambiguity

It turns your Problem slide into a diagnostic.

Use diagrams like this to increase perceived founder–market fit.

3. The “Insight → Wedge → Platform” Diagram

(Best for: pre-product founders)

This diagram visualizes your path from:

1️⃣ pain insight

2️⃣ wedge product

3️⃣ platform potential

4️⃣ category creation

Example:

Insight: “Fragmented decision-making slows scaling teams.”

→

Wedge: “AI triage engine for exception handling.”

→

Platform: “Cross-functional workflow orchestration layer.”

→

Category: “Intelligent operations cloud.”

VCs understand this instantly because it mirrors how they evaluate market potential.

This is one of the strongest visuals for early-stage meetings.

4. The “3-Step Solution Summary” Micro-Flow

(Best for: Simple routes into complex products)

This is especially effective if your product has many features but your deck needs simplicity.

Example:

Step 1: Detect

“AI identifies workflow bottlenecks.”

Step 2: Decide

“Rules + AI route tasks intelligently.”

Step 3: Deliver

“Teams resolve high-risk cases instantly.”

VCs love micro-flows because they:

✔ reduce complexity

✔ make the solution digestible

✔ improve internal pitchability

✔ prove conceptual clarity

This diagram is almost always present in pitch decks that feel “clean” to investors.

DESIGN PRINCIPLES EVERY FOUNDER MUST FOLLOW (OR INVESTORS WILL NOTICE)

There are 5 rules founders should follow:

1. Use high contrast, low color

Blue → Grey → White

Avoid gradients unless subtle.

2. No clipart, no cheesy icons

Minimal, geometric shapes only.

3. Avoid UI screenshots on the Solution slide

They distract from your value narrative.

4. Maintain consistent spacing + alignment

Inconsistency signals amateurism.

5. Use boldness strategically

Bold for outcomes, not for features.

This is exactly how YC, Sequoia, and Index-backed founders design their decks.

WHY VISUALS MATTER TO INVESTORS

Because visuals:

✔ reduce cognitive load

✔ increase perceived intelligence

✔ boost narrative retention

✔ enable internal socialization of your idea

✔ make your deck feel “premium”

✔ improve comprehension of complex ideas

A founder with great visuals looks:

thoughtful

structured

high-agency

strategic

confident

Investors subconsciously associate design clarity with execution clarity.

13 — WHAT VCs READ FIRST

(How Your Problem & Solution Slides Reshape the Priority Order of Your Entire Deck)

There’s a myth founders believe:

“Investors read my pitch deck in order.”

They don’t.

Not even close.

Inside VC firms, decks are not read linearly — they are scanned according to a hidden internal priority system.

And this priority system heavily depends on the quality of your Problem & Solution slides.

When these two slides are strong:

→ investors reshuffle the entire deck in your favor.

When these two slides are weak:

→ investors skip most of your deck entirely.

This section reveals the internal logic that determines what VCs look at next — and in what order — based on how convincing your first two slides are.

This is insider knowledge most founders never hear.

THE HIDDEN VC READING ORDER (Based Entirely on Your Problem & Solution Slides)

Investors subconsciously decide how to read your pitch deck within the first 12 seconds.

Here’s the exact reading order that emerges depending on how you present your Problem & Solution.

1. If your Problem slide is weak → investors skip HALF your deck

When your Problem slide feels:

✘ vague

✘ generic

✘ small

✘ “nice-to-have”

✘ low urgency

✘ poorly articulated

Here’s what investors skip:

• Team

• Product

• Roadmap

• Go-to-market

• Competition

• Vision

VCs think:

“If the problem isn’t big, nothing else matters.”

They don’t explicitly say it —

they simply stop reading.

2. If your Solution slide is weak → investors jump straight to Traction

This is the second most common redirection.

If your Solution slide feels:

✘ like a feature

✘ generic

✘ oversold

✘ not inevitable

✘ too complex

✘ or disconnected from the Problem slide

VCs think:

“The only way this works is if traction proves it.”

So they skip to your metrics slide.

This is why founders with no traction must have a world-class Solution slide — or they get filtered out.

3. If your Problem & Solution are strong → investors jump to TAM + Competition

This is a good sign.

VCs believe:

“If the pain is big and the solution is elegant, I need to see the scale.”

So they move to:

✔ TAM

✔ market dynamics

✔ competitive landscape

✔ why now

Strong Problem/Solution → shifts investor attention to opportunity size, not risk.

This shift is critical for improving your investment chances.

4. If your Problem & Solution show UNIQUE insight → investors jump straight to “Team”

This is the best-case scenario.

VCs think:

“These founders clearly understand the space — who are they?”

When this happens early:

✔ your meeting odds double

✔ questions become more serious

✔ internal advocacy increases

This is where founder–market fit becomes a major selling point.

VCs are more willing to back founders with deep clarity over founders with early traction.

5. When Problem + Solution + Use Case are strong → investors jump to ‘Go-To-Market’

This means:

✔ they believe in the pain

✔ they believe in the solution

✔ they believe in the wedge

✔ they can visualize real usage

Now they ask:

“Can this team get distribution? Can they acquire customers efficiently?”

GTM only matters after the Problem & Solution slides earn investor attention.

6. When the first two slides feel “investable” → investors read your deck in full (rare)

Very few decks earn a complete read-through.

When they do, investors think:

“This is serious — I need to understand everything about this company.”

This full read-through only happens when Problem & Solution are:

✔ crisp

✔ inevitable

✔ insightful

✔ structured

✔ emotionally resonant

✔ logically tight

✔ founder-market fit aligned

If you want investors to read your deck in full, your Problem & Solution slides need to be world-class.

Our Funding Blueprint Kit gives you the exact system:

Replace Your $5K Pitch Deck Consultant With One System

Used by founders who’ve collectively raised $40M+.

A VC-Ready Pitch Deck, Sales Deck & AI Financial System.

See what’s included → [link: /VC PITCH DECK]

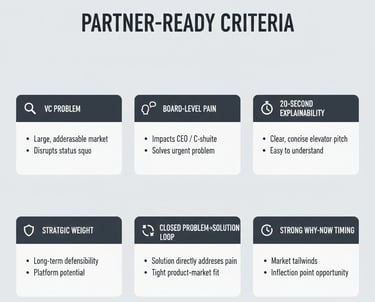

14 — HOW TO MAKE YOUR PROBLEM & SOLUTION SLIDES “PARTNER-READY”

(The Level ABOVE VC-Ready — What Actually Gets You Into IC Discussions)

Most founders aim to make their deck “VC-ready.”

But the founders who raise fast… aim higher.

They build Partner-ready slides.

What’s the difference?

👉 VC-ready = convinces an analyst or associate.

👉 Partner-ready = convinces a Partner to take you to IC (Investment Committee).

Here’s the truth most accelerators never tell you:

Partner-ready Problem & Solution slides are the #1 predictor of whether a startup makes it to a final decision.

Partners don’t care about polished design.

They don’t care about buzzwords.

They don’t care about generic problem statements.

They care about two things:

✔ Narrative clarity

✔ Internal pitchability

If a Partner can’t pitch your idea internally in 20 seconds, you will NEVER reach IC — no matter how good your traction is.

So Section 14 breaks down the exact criteria Partners use to evaluate whether your P + S slides are strong enough to move forward.

These criteria are rarely shared publicly.

This is real insider decision logic.

THE 6 TRAITS OF “PARTNER-READY” PROBLEM & SOLUTION SLIDES

These are the hidden signals Partners look for — consciously or subconsciously.

1. The Problem Must Sound Like a “VC Problem,” Not a “Founder Problem”

Partners don’t fund:

✘ hobbies

✘ annoyances

✘ workflow preferences

✘ small optimizations

✘ feature gaps

They only fund structural, expensive, compounding pain.

A Partner-ready Problem slide sounds like:

✔ “This issue destroys revenue.”

✔ “This pain compounds operational friction.”

✔ “This bottleneck scales with the market.”

✔ “This is a C-level KPI issue.”

✔ “This problem accelerates every year.”

If your problem fits this mold, you instantly feel investable.

2. The Problem Must Be “Board-Room Relevant”

Great problems are not just workflow annoyances.

They have board-level consequences.

Examples of board-level pain:

• churn

• margin erosion

• compliance risk

• slow time-to-market

• unit economics breakdown

• cash cycle delays

• hiring inefficiencies

• sales leakage

If your Problem slide hits one of these categories, Partners lean forward.

3. The Solution Must Be Explainable in 20 Seconds

This is the most Partner-specific requirement.

Partners must sell you internally.

Which means:

✔ The solution must be simple

✔ It must sound inevitable

✔ It must be easy to summarize

✔ It must feel logical

✔ It must solve the pain cleanly

A Partner-ready solution sounds like:

“They use AI to automatically resolve low-risk exceptions so ops teams can focus on high-value cases.”

Clear.

Logical.

Pitchable.

If a Partner cannot explain your solution to IC…

IC will never approve the investment.

4. Your Solution Must Have “Strategic Weight,” Not Just Utility

Partners have a sixth sense for “lightweight” solutions.

Signals of lightweight solutions:

✘ too many features

✘ unclear wedge

✘ small workflow improvement

✘ low switching cost

✘ easily copyable

Signals of strategic solutions:

✔ market-shaping potential

✔ workflow centrality

✔ compounding value

✔ data moats

✔ platform expansion routes

This is why your Solution slide must show more than a feature —

it must show the beginning of a category.

5. The Problem & Solution Must Form a “Closed Loop”

Partners instantly reject decks where:

• Problem ≠ Solution

• pain ≠ outcome

• bottleneck ≠ product

• economics ≠ ROI

• urgency ≠ adoption

Partners want a tight, closed loop, like:

Pain: “Triage bottlenecks slow operations.”

Solution: “AI triage for exceptions → speeds up operations.”

Tight loops → high trust.

Loose loops → instant rejection.

This is the #1 place weak founders fail.

6. The Slides Must Enable a Strong “Why Now” Argument

Partners care deeply about timing.

A Partner-ready slide pair must subtly reveal why NOW is the right moment, through:

• macro shifts

• new tech inflections

• regulatory pressure

• workflow fragmentation

• market readiness

• rising costs

• AI adoption

“Why Now” must be baked into the Problem & Solution slides —

not relegated to a later slide.

THE PARTNER TEST (The Real Decision Filter)

Partners silently run this test the moment they finish your Solution slide:

“Can I pitch this startup internally to my IC without sounding confused?”

If the answer is YES,

you get a meeting.

If the answer is NO,

your deck gets archived forever.

This is why “partner-ready” is a whole level above “VC-ready.”

What Happens When Your Slides Are Partner-Ready?

When both slides meet these criteria, three things happen:

1️⃣ Partners champion your deal internally

2️⃣ Other partners become curious

3️⃣ IC becomes about opportunity, not risk

This is the path every funded startup took — whether they know it or not.

Strong Problem + Strong Solution =

internal momentum

internal momentum =

funding probability skyrockets

🔗 Internal Links (in-section)

Full deck architecture → [link: /vc-pitch-deck-guide]

Validate if your slides are “partner-ready” → [link: /ai-pitch-deck-analysis]

15 — THE COMPLETE VC CHECKLIST FOR PROBLEM & SOLUTION SLIDES

(What Analysts, Principals & Partners Each Look For — The Unfiltered Internal Criteria)

Most founders write Problem & Solution slides based on intuition.

But inside VC firms, these two slides are evaluated using clear internal checklists, even if the firm never admits it publicly.

These checklists differ by role:

✔ Analysts → Scan for clarity + risk

✔ Principals → Scan for logic + viability

✔ Partners → Scan for narrative + investability

This is why some decks pass an analyst, but die at principal review…

why some pass principals, but die at partner review…

and why only 1–3% reach IC.

This section reveals the actual criteria used inside VC funnels — broken down by role — so you can craft your Problem & Solution slides to satisfy every level of evaluation.

This is the most operationally valuable section in Pillar 2.

THE 3–LEVEL EVALUATION FRAMEWORK FOR PROBLEM & SOLUTION SLIDES

Each role has different goals, incentives, fears, and evaluation criteria.

Let’s break it down.

LEVEL 1 — ANALYST CHECKLIST

(The “Immediate Filter”)

Analysts are the gatekeepers.

Their job is NOT to find winners —

it is to filter out time-wasters.

They ask:

✔ Is the problem clear in 5–7 seconds?

If they have to reread, you’re out.

✔ Is the problem big enough to justify a venture-scale company?

Not a workflow annoyance.

✔ Is the problem “pain,” not “friction”?

Friction = No.

Pain = Maybe.

✔ Does the solution map cleanly to the problem?

Mismatch = immediate rejection.

✔ Is the solution simple enough to understand?

Complex = “too risky to escalate.”

✔ Is there a wedge?

They’re trained to detect “features disguised as startups.”

✔ Does this feel like a founder with deep insight?

Generic phrasing triggers suspicion.

✔ Is the deck visually clean?

Messy slides get skimmed → skipped → archived.

Analysts have 4,000+ decks to triage.

They invest in clarity above everything.

Test your analyst-readiness → [link: /ai-pitch-deck-analysis]

LEVEL 2 — PRINCIPAL CHECKLIST

(The “Strategic Logic” Evaluation)

Principals (or associates on partner track) think differently.

They ask:

✔ Does the problem have compounding consequences?

Static problems → low TAM

Dynamic problems → growing TAM

✔ Does the solution fit into existing workflows realistically?

If adoption looks hard → risk score increases.

✔ Is the wedge strong enough to enter the market?

They deeply evaluate wedge → platform logic.

✔ Is the solution defensible long-term?

Not the product — the strategy.

✔ Are current alternatives weak or misaligned?

Principals want to see real contrast.

✔ Can this solution become a category?

Not every idea can (or should).

✔ Is the founder’s understanding deep enough for scaling?

They look for signs of strategic intelligence.

This is where decks often die:

The founder seems smart, but the idea seems small.

LEVEL 3 — PARTNER CHECKLIST

(The “Would I Bet My Reputation on This?” Evaluation)

Partners have the highest bar because:

→ They must defend the investment internally.

→ They must justify it to LPs.

→ They must live with the outcome for 7–10 years.

Partners ask:

✔ Is this problem emotionally obvious and financially undeniable?

Emotion + economics = green light.

✔ Does the solution feel inevitable?

Not “cool.”

Not “innovative.”

Inevitable.

✔ Can I explain this startup to IC in 20 seconds?

If not → dead.

✔ Is the founder a category creator?

Not a feature builder.

✔ Does this fit my fund’s narrative and thesis?

Funds invest based on story, not just numbers.

✔ Does this startup have internal momentum?

Partners only champion deals that feel like “obvious opportunities.”

✔ Is the timing perfect?

Partners deeply evaluate “Why Now.”

✔ Does this startup have a credible path to $500M+?

Yes → viable.

No → pass.

If your Problem & Solution slides nail these criteria, partners often decide within minutes that you are “a live deal.”

This is where you want to be.

our homepage kit is designed EXACTLY to pass this bar → [VC PITCH DECK]

📘 In-depth Guides: PROBLEM & SOLUTION SLIDES

Below are deeper, judgment-focused breakdowns that show how VCs evaluate Problem and Solution slides — and why these two slides quietly anchor the entire pitch-deck decision process.

SUB-PILLAR 1: What Makes a “Real” Problem Slide (Investor Definition)

SUB-PILLAR 2: How to Prove Your Problem Is Real (Evidence, Signals & Proof)

SUB-PILLAR 3: How to Frame the Solution Slide (Without Overclaiming)

SUB-PILLAR 4: Connecting Problem → Solution Like a VC (Narrative Logic Model)

SUB-PILLAR 5: Problem/Solution Slides by Stage: Pre-Seed → Seed → Series A

SUB-PILLAR 6: Common Founder Mistakes on Problem & Solution Slides

SUB-PILLAR 7: Tactical Design Rules for Problem & Solution Slides

SUB-PILLAR 8: Investor Psychology Behind Problem/Solution Slides

SUB-PILLAR 9: Examples: Good vs Bad Problem & Solution Slides (VC Analysis)

FAQ — Problem & Solution Slides (2025 VC Standard)

Below are the most commonly searched, founder-asked, and VC-relevant questions about Problem & Solution slides. These are crafted to hit multiple SEO intents:

✔ informational

✔ practical

✔ technical

✔ investor psychology

✔ narrative strategy

✔ “how-to” queries

✔ examples & mistakes

This FAQ positions your page as a definitive authority on the topic.

1. What do VCs look for first on the Problem slide?

Investors look first for pain clarity:

Is the problem:

✔ big?

✔ financially painful?

✔ urgent?

✔ accelerating?

✔ owned by a budget-holder?

✔ underserved today?

If the Problem slide cannot convince an analyst in under 7 seconds, the rest of the deck is usually skipped.

Validate your Problem slide clarity → [link: /ai-pitch-deck-analysis]

2. What makes a Problem slide strong enough without traction?

Use:

founder insight

industry data

customer interviews

workflow pain

steps describing “a day in the life”

trend-based accelerators

economic impact

Investors fund insight, not traction.

Your narrative must show you deeply understand the problem.

3. How do I show the problem is urgent and not just interesting?

Show:

time lost

money wasted

teams blocked

compliance risk

customer churn

operational delays

KPI impact

Urgency = quantifiable pain + real consequences.

4. What are the biggest mistakes founders make on Problem slides?

The top mistakes are:

❌ vague pain

❌ no payer

❌ no evidence

❌ overly broad statements

❌ founder POV instead of customer POV

❌ no acceleration trends

❌ “nice-to-have” problems

Full list explained earlier → [link: /vc-pitch-deck-guide]

5. How do I describe my Solution without over-explaining it?

Use a 3–5 step “How It Works” micro-flow, focusing on:

Input

Processing

Output

Result

Impact

This avoids feature overload and makes the product internally pitchable.

6. What is the ideal length of a Solution slide?

One sentence (value proposition)

one micro-flow diagram

one clear measurable outcome

If it takes more than 30 seconds to understand, it’s too long.

7. Should I show product UI on the Solution slide?

No — not on the main slide.

UI belongs in appendix or demo.

Solution slides should focus on:

✔ clarity

✔ ROI

✔ workflow impact

✔ inevitability

UI distracts from narrative.

8. How do I make sure my Problem & Solution “match”?

You need a closed loop:

problem → pain

pain → cause

cause → fix

fix → product

product → outcome

When this loop is tight, your deck feels inevitable.

9. Should I talk about competitors on the Problem or Solution slide?

Only INDIRECTLY.

Example:

“Legacy tools rely on manual workflows and break under volume.”

This frames weakness without naming names.

Full competitive strategy is handled later in the deck.

10. How do VCs decide if my solution is “defensible”?

They look for:

proprietary data

workflow insight

switching cost