Investor Psychology Behind Problem & Solution Slides

Understand how VCs psychologically evaluate problem and solution slides, what signals trigger conviction, and what silently destroys trust.

PILLAR 2: PROBLEM & SOLUTIONS SLIDES

12/14/20254 min read

Introduction

Most founders treat the Problem and Solution slides as explanatory tools.

Investors don’t.

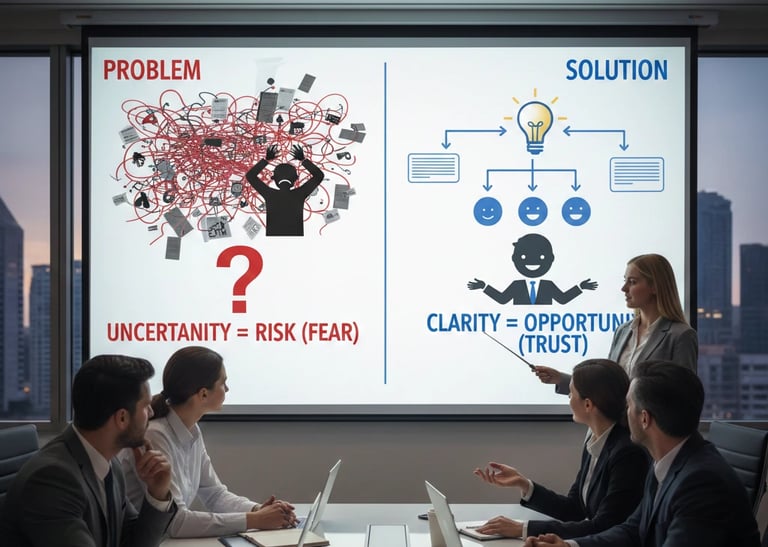

To a VC, these slides are psychological instruments — used to judge how you think, how you perceive risk, and whether your worldview aligns with reality.

Long before market size or traction, investors ask one quiet question:

Does this founder understand the problem the way a great investor would?

This guide unpacks how VCs actually think, filter, and predict outcomes using your Problem and Solution slides — and how founders can align with that mental model inside the broader Problem & Solution Slides framework.

Section 1: The Problem Slide Is a Judgment Test, Not a Description

Hook

VCs aren’t checking what problem you picked. They’re judging how you framed it.

Strategic Insight

Investors use the Problem slide to assess your cognitive framing ability — can you isolate the core constraint that actually matters?

Investor Psychology

Experienced investors know most startups fail due to misdiagnosed problems, not weak execution. They look for clarity over completeness.

Founder Application

Strip the problem to its irreducible pain point. If your slide needs context to be understood, it’s already weak.

Tactical Framework

One primary problem

One affected user

One measurable consequence

Example

“Businesses waste time on invoices” signals shallow thinking.

“SMBs lose 12–18% cash flow annually due to delayed invoice reconciliation” signals judgment.

Section 2: Investors Look for Pattern Recognition, Not Novelty

Hook

VCs trust patterns more than originality.

Strategic Insight

Your problem is evaluated against hundreds of similar decks investors have already seen.

Investor Psychology

When a problem fits a known failure pattern — fragmented workflows, manual processes, regulatory friction — investors feel safer.

Founder Application

Anchor your problem to familiar investor mental models, then show what’s different.

Tactical Framework

Start with a known category

Narrow to a specific pain

Highlight why it persists

Example

“Healthcare data is broken” is noise.

“Prior auth delays cost mid-size clinics 7–9% annual revenue” maps to a known pattern.

Section 3: Emotional Weight Matters More Than Logical Accuracy

Hook

Investors act on conviction, not correctness.

Strategic Insight

A problem slide must feel urgent, not just logically sound.

Investor Psychology

VCs subconsciously ask: Would I personally worry about this problem if I ran this business?

Founder Application

Translate abstract pain into felt consequences — stress, loss, risk, or missed opportunity.

Tactical Framework

Quantify downside

Show who feels the pain daily

Make inaction uncomfortable

Example

“Manual compliance is inefficient” vs.

“Compliance errors trigger audits that freeze operations for 3–6 months.”

Section 4: The Solution Slide Tests Founder Restraint

Hook

Overconfident solutions reduce trust.

Strategic Insight

The Solution slide isn’t about impressing — it’s about demonstrating restraint.

Investor Psychology

Great founders don’t promise outcomes. They show controlled leverage.

Founder Application

Describe what changes, not how powerful you are.

Tactical Framework

What specific friction is removed

What new behavior becomes possible

What remains intentionally unsolved

Example

“AI-powered platform that automates everything” signals naivety.

“Automates one bottleneck in claims processing” signals maturity.

Section 5: Investors Mentally Simulate Failure Paths

Hook

Every investor is running a silent downside analysis.

Strategic Insight

Your problem/solution pairing is tested against failure scenarios.

Investor Psychology

If the problem disappears, shrinks, or evolves — does the solution still matter?

Founder Application

Show durability without defending it aggressively.

Tactical Framework

Why the problem persists

Why alternatives haven’t solved it

Why timing now is rational

Example

If regulation changes tomorrow, does your solution still provide value?

Section 6: Mismatch Between Problem Depth and Solution Scope Kills Trust

Hook

Big solution for a small problem is a red flag.

Strategic Insight

Investors look for proportionality between problem severity and solution ambition.

Investor Psychology

Overbuilt solutions suggest founders chasing scale before truth.

Founder Application

Right-size your solution to the problem you’ve proven.

Tactical Framework

Match solution scope to pain intensity

Avoid feature sprawl

Earn expansion later

Example

A massive platform solving a minor workflow issue signals future burn problems.

Section 7: Investors Use These Slides to Predict Founder Coachability

Hook

These slides reveal how you’ll respond to feedback.

Strategic Insight

Problem/Solution framing shows whether you’re defensive or adaptive.

Investor Psychology

Founders who acknowledge uncertainty signal growth potential.

Founder Application

Leave space for iteration — not certainty.

Tactical Framework

Avoid absolutes

Show learning loops

Signal openness to refinement

Example

“This is the only way” vs.

“This is our current best approach based on observed behavior.”

Section 8: The Slides Create the First Trust Deposit

Hook

Trust starts before traction.

Strategic Insight

These slides form the first credibility deposit in the investor relationship.

Investor Psychology

VCs decide whether to lean in or lean back within minutes.

Founder Application

Optimize for believability, not brilliance.

Tactical Framework

Plain language

Honest constraints

Clear logic chain

Example

Simple, grounded slides often outperform “impressive” ones.

Section 9: Investors Remember Logic, Not Slides

Hook

Investors don’t remember decks — they remember logic.

Strategic Insight

A strong Problem → Solution narrative becomes repeatable inside partner meetings.

Investor Psychology

If an investor can’t explain your logic to another partner, the deal stalls.

Founder Application

Ask: Can someone else retell this without me?

Tactical Framework

One-sentence problem

One-sentence solution

One clear causal link

Example

If your story survives retelling, you’ve passed the test.

Section 10: What Investors Never Tell You Directly

Hook

Most rejections are psychological, not analytical.

Strategic Insight

Investors rarely say why your slides didn’t work — but they know instantly.

Investor Psychology

They’re protecting time, reputation, and internal confidence.

Founder Application

Treat these slides as a mirror, not a pitch.

Tactical Framework

Audit framing, not features

Remove ego

Optimize for clarity under scrutiny

Example

The best decks feel obvious in hindsight — that’s not accidental.

FAQ

Do investors really judge founders from just two slides?

Yes. These slides often determine whether the rest of the deck gets attention.

Should I make the problem sound bigger than it is?

No. Exaggeration reduces trust faster than underclaiming.

Is emotion or data more important here?

Emotion drives attention; data sustains belief. You need both.

Can a strong solution compensate for a weak problem?

Almost never. Investors back problems first.

Do these slides matter more than traction at early stage?

Often yes — especially at Pre-Seed and Seed.

Funding Blueprint

© 2025 Funding Blueprint. All Rights Reserved.