PILLAR 5 — STORYTELLING & NARRATIVE ENGINEERING (2025 EDITION)

SECTION 1 — Why Storytelling Is the Founder’s Most Powerful Fundraising Weapon

If great pitch decks were only about facts, logic, TAM, GTM, traction, or numbers, founders with the best spreadsheets would get funded every time.

But that’s not how venture capital works.

The founders who win:

✔ build emotional momentum

✔ shape belief

✔ reduce uncertainty

✔ sequence information deliberately

✔ remove cognitive friction

✔ create inevitability

✔ deliver clarity under pressure

✔ make investors feel the future

This is the essence of storytelling — not fiction, not exaggeration, not hype…

but narrative engineering.

Because in fundraising, the investor isn’t just evaluating what your startup is today —

they’re evaluating what your startup could become.

And storytelling is the bridge between those two worlds.

Investors don’t invest in slides.

They invest in stories that feel inevitable.

Many founders try to fix these clarity gaps manually, but most don’t realize how much easier it becomes when your pitch follows a proven structure. If you want to see how a complete, investor-ready deck is laid out, check the full VC Pitch Deck System on our homepage — it shows the exact architecture founders use to reduce skepticism and increase perceived authority.

⭐ The Harsh Reality Most Founders Don’t Know

Most founders think storytelling means:

❌ telling a cute anecdote

❌ speaking with passion

❌ adding emotional words

❌ making slides look pretty

❌ “pitching from the heart”

But investors don’t fund passion.

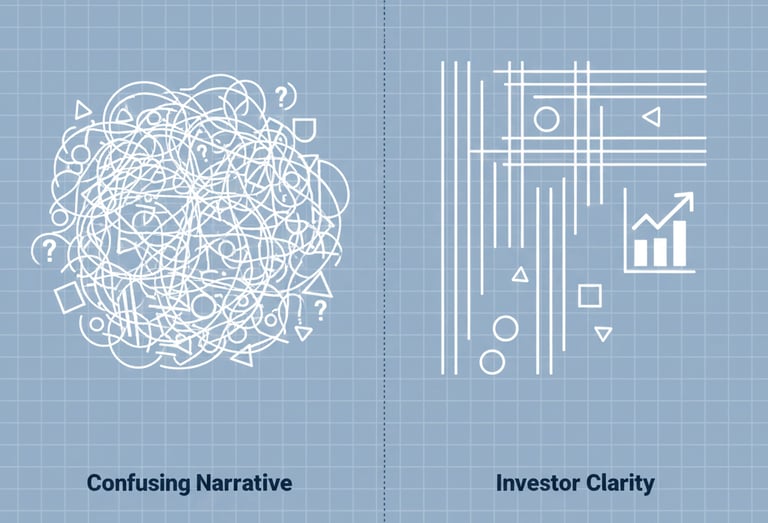

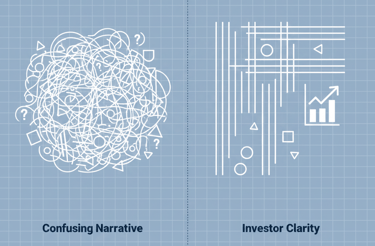

They fund clarity engineered into narrative structure.

Storytelling in fundraising is about:

✔ controlling the cognitive load

✔ reducing perceived risk

✔ shaping investor assumptions

✔ making the logic feel effortless

✔ sequencing information to maximize belief

✔ letting the investor arrive at the conclusion on their own

A great narrative makes the investor think:

“This just makes sense… and it feels obvious.”

When that happens, conviction forms.

And conviction is what gets founders funded.

⭐ Why Storytelling Matters More in 2025 Than Ever

Investors today are:

overwhelmed with deal flow

burned out from AI pitches

skeptical of hype decks

pattern-matching harder than ever

relying on cognitive shortcuts

screening faster

focusing more on founder psychology

more valuation-sensitive

In this environment, the founders who can:

✔ simplify complexity

✔ create emotional clarity

✔ build inevitability

✔ structure narrative like a professional

…win deals even when their traction isn’t perfect.

This pillar will teach you EXACTLY how to do that.

⭐ One-Line Summary of Section 1

“Storytelling is the psychological engine behind investor conviction — without narrative clarity, even strong traction can be ignored.”

SECTION 2 — The “Narrative Arc” Framework

How Great Pitch Decks Follow the Same 5-Stage Emotional Sequence**

Most founders write their pitch deck as a set of slides.

Great founders design their pitch deck as a story arc.

This difference alone separates the founders who confuse investors…

from the founders who create momentum.

The great decks — the ones from Airbnb, Rippling, Linear, Notion, Uber, Canva — all follow the same sequence:

⭐ The 5-Stage Narrative Arc Used by Top 1% Founders

① Setup — Establish the World

This is the part where investors understand:

who the user is

what the current environment looks like

what’s broken

how the world works today

This sets the baseline.

Without this baseline, your deck has no direction.

② Tension — Reveal the Pain & Stakes

This is where you show:

pain

cost

friction

urgency

why this matters

This is the emotional core of the pitch.

Investors must feel the problem or there is no momentum.

③ Insight — The Breakthrough Understanding

This is the rare moment when the investor thinks:

“Oh… they’ve understood something others have missed.”

This could be:

a counterintuitive truth

a pattern you discovered

a workflow gap no one has solved

a domain insight

a structural shift

This insight is what transforms your pitch into something fundable.

Many founders study the VC PITCH DECK GUIDE to learn exactly how to craft this insight so it feels precise, rare, and investor-calibrated.

④ Solution — The Product That Resolves the Tension

Now your product finally appears — but only after the narrative has created emotional readiness.

Product with no tension = ignored.

Product after insight = inevitable.

⑤ Inevitability — The Future That Becomes Obvious

This is where founders make the investor feel:

“This direction makes sense.”

“This founder will build this no matter what.”

“This will happen with or without us.”

“This is the right moment.”

This stage is where conviction forms.

⭐ Why This Arc Works

Because this sequence matches the emotional flow of a real investor:

Understand

Care

Believe

Envision

Commit

This is not “storytelling flair.”

This is psychological engineering.

Once you understand this arc, the rest of your pitch becomes effortless.

If you haven’t read the breakdown of the full investor evaluation funnel, the earlier guide ‘How VC Pitch Decks Work’ builds a great foundation. It explains how each slide interacts with investor cognition, so you can understand how your message flows through each filter.

SECTION 3 — The “Clarity Formula”:

Why Investors Fund Startups They Understand Instantly

If you could magically insert one sentence into an investor’s brain during your pitch, the sentence you want is:

“I get this.”

Not:

“I like this.”

Not:

“This is interesting.”

Not:

“This team seems smart.”

The single most powerful emotion in a VC’s head — the one that drives fast yes’s — is clarity.

Why?

Because clarity reduces perceived risk.

And in fundraising, risk perception is everything.

Even strong startups get rejected when clarity is weak.

Even average startups get funded when clarity is world-class.

⭐ The Clarity Formula (Used by Sequoia, YC, a16z)

Clarity = Simplicity × Structure × Sequence

Let’s break those down.

① Simplicity — The Investor Should Never Work Hard to Understand You

Investors evaluate:

hundreds of decks

thousands of claims

dozens of markets

multiple founders daily

Their brains crave simplicity.

Your pitch must give them:

✔ a clear user

✔ a clear problem

✔ a clear product

✔ a clear business model

✔ a clear future

Simplicity isn’t childish.

Simplicity is expert-level communication.

② Structure — Information Must Be Grouped Intentionally

Great decks don’t dump information.

They:

group ideas

chunk complexity

remove noise

build cognitive flow

reduce mental switching

Structure = investor comfort.

Investor comfort = investor conviction.

③ Sequence — Place Every Idea in the Right Order

The biggest mistake founders make is not what they say…

but when they say it.

Example:

❌ Showing the product before the problem

❌ Showing metrics before explaining how they work

❌ Explaining GTM before the business model

❌ Talking vision before traction

These break the investor’s cognitive flow.

Correct sequencing creates inevitability.

⭐ Why Clarity Feels Like Competence

When an investor instantly understands your business, they mentally assume:

✔ You understand your market

✔ You understand your user

✔ You understand your numbers

✔ You understand your execution plan

✔ You understand how to communicate under pressure

Clarity signals founder quality.

Confusion signals founder weakness.

⭐ The Golden Rule

If your pitch is clear, investors assume the business is strong.

If your pitch is confusing, investors assume the business is weak.

This is unfair — but true.

And in fundraising, truth > fairness.

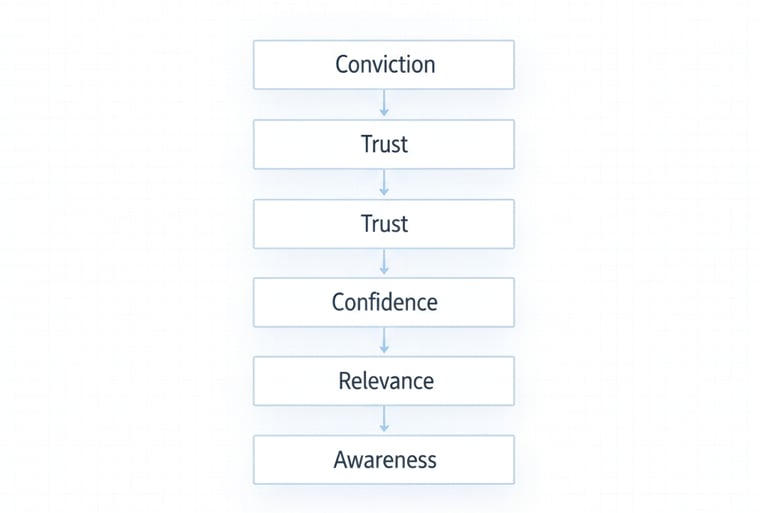

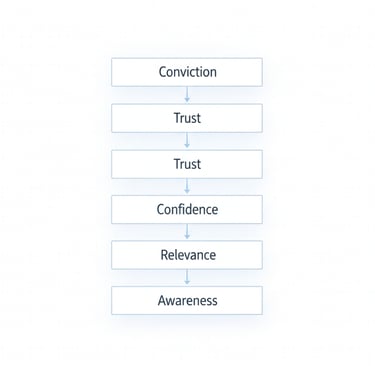

SECTION 4 — The “Belief Ladder”:

How Investors Build Conviction Step-by-Step (And How You Control It)

Investors don’t jump from “interesting idea” to “I’m wiring $500k” in one mental move.

Conviction forms through a ladder — a predictable mental progression every investor climbs unconsciously.

Your job is to guide them up that ladder one step at a time.

If you skip even one step, the pitch breaks.

Here is the ladder.

⭐ THE 6-STEP INVESTOR BELIEF LADDER

STEP 1 — Awareness

“Okay, I understand what this startup is.”

At this stage, the only job is clarity.

They should not be evaluating you.

Not yet.

STEP 2 — Understanding

“Ah, now I get how the problem works.”

They now understand:

who the user is

why the pain matters

how the industry works

what friction exists

This is where most founders fail — they assume investors already understand their market.

They don’t.

STEP 3 — Relevance

“This is actually a meaningful problem.”

Investors now believe:

the pain is real

the pain is big

the pain is expensive

the pain is urgent

users truly struggle

This is where “relatability” begins.

STEP 4 — Confidence

“These founders clearly know what they’re doing.”

Confidence forms through:

✔ Structure

✔ Simplicity

✔ Clarity

✔ High signal-to-noise ratio

✔ Founder communication style

✔ Well-engineered narrative

STEP 5 — Trust

“These founders will execute even if things get hard.”

Trust comes from:

domain insight

founder logic

maturity

calmness

non-defensive answers

precise explanations

thoughtful risks

Trust is emotional, not analytical.

STEP 6 — Conviction

“This is going to work — and I want in.”

Conviction happens when the investor believes:

✔ you understand the problem

✔ your solution is meaningful

✔ the market is big

✔ users will pay

✔ team can execute

✔ timing is perfect

This is the psychological moment you are optimizing for.

⭐ Why the Belief Ladder Matters

Because investor psychology is predictable.

If you understand this ladder, you stop “hoping” investors believe…

and start controlling the sequence in which they believe.

This is the difference between:

❌ confused founders who pray for a yes

✔ strategic founders who engineer investor conviction

SECTION 5 — The “Cognitive Load Rule”:

Why Investors Say No When Their Brain Has to Work Too Hard

When an investor reads your deck or listens to your pitch, their brain is doing two jobs at the same time:

✔ Job 1 — Understanding the facts

✔ Job 2 — Evaluating the opportunity

If Job 1 requires too much effort,

Job 2 never even begins.

This is the root reason why even good startups get rejected.

Investors don’t reject because the idea is bad.

They reject because their brain had to work too hard to understand you, so they assume the business will be even harder.

This is what “cognitive load” means.

⭐ 3 Types of Cognitive Load That Kill Investor Interest

Investors don’t articulate these — but they feel them instantly.

1. Intrinsic Cognitive Load (Complexity of the Topic Itself)

Some industries are inherently complex:

fintech

AI infrastructure

logistics

healthtech

cybersecurity

deeptech

Your job is to reduce that complexity with:

✔ simple metaphors

✔ relatable examples

✔ user-centric explanations

✔ step-by-step workflows

The startup that simplifies its market → wins.

2. Extraneous Cognitive Load (Your Fault)

This is unnecessary mental burden caused by:

❌ jargon

❌ long paragraphs

❌ unstructured slides

❌ unclear models

❌ poor diagrams

❌ bad sequencing

❌ too much detail early

❌ confusing slide titles

This is the load that makes investors think:

“I don’t get it… next.”

3. Germane Cognitive Load (The Good Load)

This is the useful mental effort investors WANT:

understanding your logic, market, and execution ability.

Your job is not to eliminate it —

your job is to guide it.

You want investors to think:

✔ “Ah, that makes sense.”

✔ “Smart insight.”

✔ “Well structured.”

✔ “Clear logic.”

✔ “I follow this.”

That’s germane load — and it increases conviction.

⭐ Why Investors Hate High Cognitive Load

Because in a world with:

100+ decks per week

multiple partner meetings

short attention spans

constant deal flow

context switching

time pressure

Anything that feels difficult is perceived as:

❌ high risk

❌ poor communication

❌ low founder maturity

❌ unclear market

❌ unclear user

❌ unclear strategy

This is why clarity isn’t a “nice to have.”

Clarity is a psychological advantage.

⭐ The Core Rule

When the brain struggles, belief collapses.

When the brain relaxes, conviction forms.

Great storytelling isn’t about drama —

it’s about reducing cognitive strain long enough for belief to emerge.

SECTION 6 — The “Tension & Release” Technique:

How to Keep Investors Emotionally Engaged Without Manipulation

If the Narrative Arc is the structure,

then Tension & Release is the emotional rhythm.

Every great pitch — every winning startup story — has moments where the investor feels:

🎯 rising stakes

🎯 emotional pressure

🎯 heightened curiosity

🎯 a sense of anticipation

🎯 “wait… so what happens next?”

This emotional dynamic is NOT manipulation.

It’s how the human brain understands meaning.

Neuroscience shows that:

Information without tension is ignored.

Information with tension is remembered.

You’re not creating drama.

You’re creating engagement.

Here’s how it works.

⭐ The 3 Types of Tension Used in World-Class Pitch Decks

1. Problem Tension

This is created when you show:

rising costs

workflow inefficiencies

user frustration

broken systems

outdated processes

economic pressure

Investors begin thinking:

“This problem is real, painful, and expensive.”

This emotional readiness is essential before showing the solution.

2. Insight Tension

This is the rare moment when you reveal:

a hidden truth

a counterintuitive insight

a pattern others missed

a structural inefficiency

a market shift

Here, the investor feels:

“Oh… now I see what they see.”

This is the strongest form of psychological engagement in a pitch.

Many founders learn how to craft these insights more powerfully by studying frameworks inside the Funding Blueprint (ADD LINK HERE), which helps sequence both tension and release with precision.

3. Market Tension

Created by showing:

shifting user behavior

rapid technological change

regulatory pressure

market fragmentation

rising category chaos

This creates urgency — the investor feels:

“This startup must exist now, not later.”

⭐ The Release Moment

Once tension peaks, you introduce the release:

clarity

calm logic

simple explanation

elegant solution

clear sequencing

sharp visuals

This is when the investor internally says:

✔ “Ahh… that makes perfect sense.”

✔ “Now it’s obvious.”

✔ “This solution is inevitable.”

That internal relief is the emotional doorway to conviction.

⭐ Why Tension & Release Works

Because humans remember contrast, not information.

Clarity feels clearer

when it follows confusion.

Simplicity feels simpler

when placed after complexity.

Your solution feels stronger

when your problem was emotionally understood.

This is narrative engineering —

not storytelling tricks.

⭐ The Rule

If the investor never feels tension → they never feel relief → they never feel belief.

This is why great founders craft tension with intention.

SECTION 7 — The “Founder Logic Test”:

How Investors Judge Your Thinking Through Your Story (Not Your Traction)

Great investors don’t invest in ideas.

Great investors don’t invest in slides.

Great investors don’t even invest in metrics early on.

They invest in founder logic.

Because logic is the indicator of:

✔ how you think

✔ how you make decisions

✔ how you prioritize

✔ how you understand trade-offs

✔ how you reason about growth

✔ how you navigate ambiguity

✔ how you solve problems under pressure

This is what investors are really buying.

Your narrative — HOW you tell your story — is their window into your mind.

⭐ What Investors Look For in “Founder Logic”

Investors judge your logic subconsciously through your narrative.

They look for:

① Precision

No unnecessary detail.

No fluff.

No rambling.

Precision signals:

discipline

clarity

control

intelligence

It tells the investor:

“This founder thinks cleanly.”

② Causality

Every part of your narrative must logically follow from the previous part.

If you show:

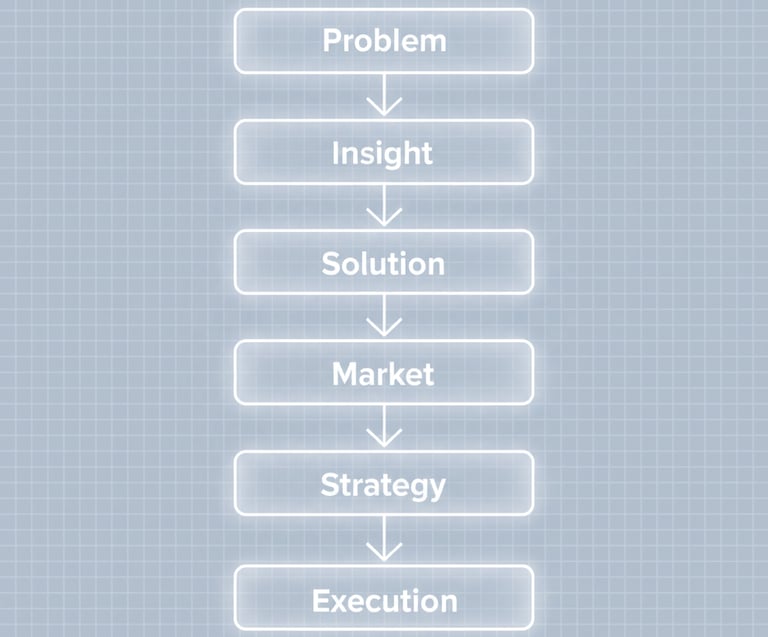

Problem → Insight → Solution → Market → Strategy → Execution

…and each one connects clearly, investors assume you can:

✔ reason about systems

✔ understand consequences

✔ make structured decisions

If the sequence breaks — even once — the investor feels cognitive discomfort.

③ Coherence

Your story must feel:

internally consistent

logically unified

focused

non-contradictory

aligned with metrics

When everything fits together, the investor’s brain relaxes.

When things don’t fit, the brain panics.

④ Efficiency

Great narrative = maximum signal, minimal noise.

Every sentence should:

✔ provide value

✔ build belief

✔ increase clarity

If your story feels efficient, investors assume your operations will be too.

⑤ Insightfulness

This is the difference between:

❌ “Smart founder”

and

✔ “Exceptional founder”

Investors want to feel:

“This founder sees something others don’t.”

This is why structured systems like the Funding Blueprint (ADD LINK HERE) are so effective — they help founders replace randomness with insight-driven sequencing.

⭐ Why Founder Logic > Traction (Especially in Early Stages)

Most founders assume traction is the main driver.

Not always.

At pre-seed and seed, investors fund:

clear logic

sharp reasoning

deep insight

coherent thinking

structured explanation

intelligent framing

Traction helps…

but logic closes the deal.

Founders with strong logic get funded even with weak or early metrics.

Founders with weak logic get rejected even with decent traction.

Logic is the lens through which investors judge everything else.

⭐ The Rule

Founders who communicate with logic signal they can execute with logic — and investors fund execution.

Your narrative is not just a story.

It’s your thinking exposed.

SECTION 8 — The “Authority Gap”:

How to Sound Like the Category Expert (Even If You’re a New Founder)

One of the biggest hidden factors in fundraising success is perceived authority.

Not real authority.

Not résumé authority.

Not domain authority.

Perceived authority.

Founders who sound like category experts raise money.

Founders who sound inexperienced get filtered out — even before traction is evaluated.

The good news?

Perceived authority is engineered through narrative, not through years of experience.

You don’t need:

❌ decades in the industry

❌ fancy credentials

❌ a famous co-founder

❌ ex-Google/Meta pedigree

What you need is how you speak about your problem, market, and user.

Here’s how to engineer authority inside your pitch.

⭐ THE 4 AUTHORITY SIGNALS INVESTORS LOOK FOR

1. Domain Language Mastery

Not jargon.

Not buzzwords.

Domain language is the ability to:

✔ name the pain precisely

✔ describe workflows accurately

✔ understand real user behaviors

✔ reference actual bottlenecks

✔ talk in specifics, not generalities

When founders talk like operators, investors assume:

“They’ve lived this problem.”

2. Pattern Recognition

Authority comes from showing patterns such as:

user behaviors

market inefficiencies

data anomalies

workflow gaps

industry shifts

business model constraints

When you point out patterns, investors feel:

“This founder understands the deeper mechanics here.”

3. Market Context Awareness

Founders who raise successfully show they understand:

history of the category

recent shifts

competitor blind spots

upcoming regulatory pressure

macro trends shaping demand

This signals you’re not just building a product —

you’re building a solution shaped by context.

4. Insight Strength

Insight is the source of founder authority.

Insights like:

“Users don’t do X, they actually do Y.”

“Competitors think the bottleneck is A, but it’s actually B.”

“The industry has optimized Z for 10 years, but it should’ve optimized Q.”

These insights don’t require 20 years of experience.

They require correct observation.

⭐ Why Authority Matters More Than Ever (2025 Edition)

Today’s investors face:

too many AI pitches

too many generalist founders

too much noise

too many templates copying each other

Authority is a differentiator.

Investors don’t want founders who seem excited.

They want founders who seem competent.

And competence is communicated primarily through narrative.

⭐ The Rule

If you sound like the category expert → investors treat you like the category expert.

Authority is not a status you earn.

Authority is a status you communicate.

To strengthen this authority positioning, revisit the Problem & Solution Slides pillar — it shows how to frame pain points and insights with the precision investors expect from domain experts.

SECTION 9 — The “Emotional Anchors”:

How to Make Investors Remember Your Startup After the Meeting

Here’s something founders never realize:

Investors don’t fund the startups they understand the most.

They fund the startups they remember the most.

VCs talk to:

10+ founders a day

40+ founders a week

150+ founders a month

1,000+ founders a year

The biggest psychological challenge in fundraising is not:

❌ explanation

❌ clarity

❌ traction

❌ excitement

The real challenge is:

memorability.

If your pitch is forgotten by the next morning, your deal is dead.

This is where emotional anchors come in.

⭐ The 3 Emotional Anchors That Make Your Startup Stick in a VC’s Brain

These are engineered, not accidental.

Anchor 1 — The Core Insight (the “Aha Moment”)

This is the moment an investor feels:

“Oh wow… that’s actually true.”

This happens when you reveal a counterintuitive insight or a hidden pattern.

Example anchors:

“Users don’t fail because of X… they fail because of Y.”

“Competitors think the bottleneck is A, but it’s actually B.”

“Everyone optimizes this step, but the real inefficiency starts earlier.”

This insight becomes a mental hook.

If you give investors one insight they repeat to others, you’ve won.

Anchor 2 — The Human Moment

Not drama.

Not sob stories.

Not emotional manipulation.

A human moment is something relatable:

a user story

a founder origin

a real workflow failure

a personal frustration

a clear “this happened” moment

Investors remember humans, not features.

When a story feels personal and real, it becomes an emotional bookmark.

Anchor 3 — The Inevitability Statement

This is the sentence that makes investors feel:

“This startup must exist.”

You don’t say it arrogantly.

You say it factually, simply, and inevitably.

Examples:

“Every company will need this in the next 3 years.”

“This is the shift that will rewrite the category.”

“This will become the default workflow because the old model can’t scale.”

Inevitability is the strongest emotional anchor.

⭐ Why Emotional Anchors Matter More Than Slides or Metrics

After your meeting, investors don’t remember:

exact numbers

full product details

every slide in your deck

They remember 2–3 emotional moments.

Those 2–3 moments are what:

✔ get repeated in partner meetings

✔ get discussed with other investors

✔ carry your pitch into the next round

✔ turn interest into conviction

✔ turn conviction into term sheets

Narrative = memory.

Memory = momentum.

Momentum = money.

⭐ The Rule

If your pitch isn’t memorable, it’s un-fundable.

If you engineer 2–3 emotional anchors, you can win even with weaker traction.

This is how modern fundraising psychology works.

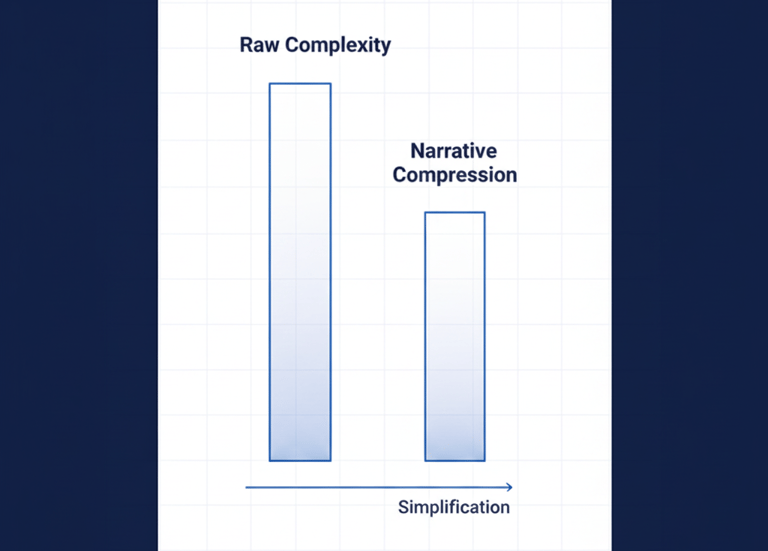

SECTION 10 — The “Narrative Compression Effect”:

How to Communicate 10 Minutes of Insight in 10 Seconds (Like Top Founders Do)

Investors do NOT reward founders who give the most information.

Investors reward founders who give the least information to create the maximum clarity.

This is the heart of narrative compression — the ability to reduce complexity without reducing meaning.

In simple terms:

Narrative compression = maximum meaning, minimum words.

This is one of the strongest psychological signals of founder intelligence.

Great founders are master compressers.

Weak founders drown investors in detail.

⭐ Why Narrative Compression Is a Superpower

VCs sit through:

overloaded slides

dense explanations

jargon-filled decks

rambling problem descriptions

overly technical demos

When your narrative is compressed, investors feel:

✔ “This founder thinks clearly.”

✔ “This founder communicates like a CEO.”

✔ “I understand this instantly.”

✔ “This seems easier to scale.”

Clarity feels like competence.

Compression feels like mastery.

⭐ The 3 Levels of Narrative Compression

There are three compression layers used by elite founders.

LEVEL 1 — Word Compression

This is eliminating noise.

Examples:

❌ “Our product leverages a wide range of… blah blah…”

✔ “We automate the part everyone hates.”

❌ “Users can implement our workflow adjustments by…”

✔ “It saves teams 4–6 hours a week.”

The fewer the words → the higher the perceived clarity.

LEVEL 2 — Concept Compression

This is where multiple ideas are merged into one clear, elegant concept.

Examples:

❌ “We solve X, Y, and Z with A, B, and C.”

✔ “We eliminate manual billing errors — forever.”

❌ “We have 12 AI features.”

✔ “It runs itself.”

Concept compression is a form of executive intelligence.

LEVEL 3 — Narrative Compression (The Highest Level)

This is where your entire story becomes one message:

“This makes sense.”

Investors should understand:

✔ the user

✔ the pain

✔ the insight

✔ the solution

✔ the market

✔ the strategy

✔ the inevitability

…in seconds, not minutes.

⭐ Narrative Compression Isn’t Just About Clarity — It’s About Authority

When you compress your story:

you sound like a CEO

you demonstrate mastery

you show deep market understanding

you communicate like someone experienced

you reduce cognitive strain dramatically

Investors subconsciously think:

“If they explain like this, they build like this.”

Narrative compression is a proxy for operational excellence.

⭐ Example of Narrative Compression in Action

❌ Bad (Typical Founder):

“We help mid-market accounting teams integrate cross-border financial reconciliation workflows using AI-driven data-pipeline automation…”

✔ Good (Top 1% Founder):

“We eliminate 80% of manual finance work.”

That's narrative compression.

And that’s the version investors remember.

⭐ The Rule

Shorter narrative = stronger conviction.

Clearer story = clearer belief.

Investors don’t need more information.

They need compressed information delivered with precision.

SECTION 11 — The “Founder Credibility Cues”:

How Investors Judge You in the First 30 Seconds (Before You Even Start Pitching)

Founders think credibility is built through:

traction

revenue

testimonials

design

logos

awards

Those things help later,

but credibility is actually judged instantly —

within the first 30 seconds of your call or the first 10 seconds of reading your deck.

This is because the human brain uses snap cognitive heuristics to evaluate:

✔ intelligence

✔ competence

✔ trustworthiness

✔ confidence

✔ communication ability

✔ likelihood of execution

Whether you know it or not,

investors are forming a psychological profile of you

before you even start telling your story.

Here are the cues they look for.

⭐ THE 6 CREDIBILITY CUES INVESTORS SUBCONSCIOUSLY USE

1. Cognitive Sharpness

How quickly you respond.

How you phrase things.

How you summarize ideas.

Sharpness signals:

✔ intelligence

✔ clarity

✔ decisiveness

✔ leadership potential

2. Calmness Under Pressure

If an investor challenges you and you stay:

calm

logical

precise

non-defensive

thoughtful

…you pass the CEO test.

If you respond nervously or too aggressively,

credibility drops instantly.

3. The “No Noise” Principle

The absence of unnecessary detail makes you seem:

disciplined

focused

confident

Founders who ramble signal:

❌ insecurity

❌ lack of domain depth

❌ chaotic thinking

Noise = risk.

4. Specificity

General founders say:

❌ “The market is big.”

❌ “Users are struggling.”

❌ “Competitors aren't great.”

Credible founders say:

✔ “Finance teams lose ~18–24 hours a week reconciling transactions.”

✔ “User drop-off spikes at step 3 of onboarding.”

✔ “Competitors optimize for A, but the real bottleneck is B.”

Specificity is a credibility weapon.

5. Intentional Language

Investors judge your word choice.

High-credibility founders:

avoid hype

avoid exaggeration

use calm, factual statements

explain things simply

Examples:

✔ “We automate 80% of the workflow.”

✔ “This is the shift driving demand.”

✔ “Here’s the bottleneck we discovered.”

No hype.

No drama.

Just clarity.

6. Directional Confidence

Credible founders speak like they know where they’re going:

✔ “Here’s our path.”

✔ “Here’s what matters.”

✔ “Here’s what doesn’t.”

✔ “Here’s what we’re optimizing for next.”

Direction = leadership.

Leadership = credibility.

Credibility = investability.

⭐ Investors Aren’t Evaluating Your Startup First — They’re Evaluating You

This is the part founders miss.

Investors are thinking:

“Can this founder execute?”

“Do they think clearly?”

“Do they show self-awareness?”

“Can they lead a team?”

“Do they understand the category deeply?”

“Do they communicate with precision?”

Your narrative isn’t just telling your story.

It’s revealing who you are.

And that psychological reading happens IMMEDIATELY.

⭐ The Rule

Founders who demonstrate credibility early make investors relax — and relaxed investors say yes more often.

Great storytelling isn’t just about insight.

It’s about who you appear to be in the investor’s mind.

SECTION 12 — The “Emotional Certainty Trigger”:

How to Make Investors Feel Safe Betting on You (Even Before Metrics Are Perfect)

Here’s the psychological truth most founders never learn:

Investors don’t fund the startup that is objectively the best.

They fund the startup that feels emotionally safest.

This is why:

weaker traction companies get funded

competing founders lose to calmer communicators

average metrics beat strong metrics when the story is clearer

confident narratives outperform complex explanations

founder certainty → investor certainty

VCs aren’t machines.

They’re humans with uncertainty, pressure, deal fatigue, and FOMO.

Your job is not simply to “convince” them.

Your job is to make them feel safe.

This safety is what we call the Emotional Certainty Trigger.

⭐ What Is Emotional Certainty?

It’s the moment when an investor’s brain concludes:

“This founder will figure it out.”

Not because of traction.

Not because of resume.

Not because of hype.

Because of:

✔ clarity

✔ calmness

✔ precision

✔ coherent logic

✔ authority

✔ inevitability

✔ consistency

✔ structured narrative

Emotional certainty is the psychological foundation of every early-stage investment.

⭐ The 4 Psychological Inputs That Create Emotional Certainty

1. The Consistency Effect

Investors look for:

consistent logic

consistent tone

consistent slide flow

consistent structure

consistent answers

consistent worldview

Consistency = competence.

Inconsistency = risk.

2. The Calm Confidence Effect

Founders who speak calmly trigger subconscious signals of:

✔ control

✔ leadership

✔ maturity

✔ discipline

This is why:

calm is stronger than excitement

clarity is stronger than passion

precision is stronger than enthusiasm

VCs are not looking for hype.

They’re looking for command.

3. The Inevitability Effect

When your narrative makes your startup feel:

obvious

necessary

unavoidable

timed perfectly

…the investor feels as if they’re not “choosing” you —

they’re simply aligning with the future.

Inevitability reduces perceived risk dramatically.

4. The Low-Friction Effect

If your pitch:

is simple

is clean

is easy to follow

doesn’t overload the brain

reveals insights step-by-step

creates emotional clarity

…the investor’s cognitive system relaxes.

A relaxed mind says yes.

A stressed mind says no.

Low friction = emotional safety.

⭐ Why Emotional Certainty Can Override Weaknesses

Founders think VCs only look at weaknesses:

small revenue

limited traction

rough product

slow growth

tiny team

But emotionally certain founders make investors think:

“These weaknesses don’t matter — this founder will solve them.”

Emotional certainty reframes weaknesses as temporary,

and strengths as permanent.

This is why some founders with $0 in revenue raise $3M

and others with $20k MRR raise nothing.

⭐ The Rule

Investors don’t invest in the startup that looks the strongest.

They invest in the founder that feels the safest.

Your narrative’s job is to create emotional certainty,

so investors can confidently fill the gaps with belief.

For a deeper look into how investors form emotional certainty, the Investor Psychology pillar goes behind the scenes on how VCs assess trust, conviction, and founder intent — long before the numbers appear.

SECTION 13 — The “Narrative Momentum” Principle:

Why Some Pitches Keep Getting Stronger as They Progress (And Others Collapse Midway)

Momentum is everything in fundraising.

If your pitch starts strong but weakens halfway through, investors mentally check out and never return.

A great pitch is like a wave building power:

Each section must make the next section feel stronger.

This is Narrative Momentum — the psychological sensation that the story is accelerating, deepening, and becoming more inevitable with every slide.

When narrative momentum is strong, investors think:

✔ “This gets better and better.”

✔ “This is making more sense as we go.”

✔ “Their logic is tightening.”

✔ “I want to hear the next part.”

✔ “This founder feels sharp.”

✔ “This is starting to feel inevitable.”

When narrative momentum is weak, investors think:

❌ “This is dragging.”

❌ “Now I’m confused.”

❌ “Why did the energy drop?”

❌ “I’m losing interest.”

Momentum is a psychological force, not a storytelling trick.

Here’s how it works.

⭐ How Narrative Momentum Is Created Inside a Pitch

There are 4 core drivers of momentum — each one is essential.

1. Logical Acceleration

Each slide should make the next one feel more obvious.

For example:

Problem → Insight → Solution

should feel like:

➡ “Of course the solution looks like this.”

Not:

❌ “Wait, how did we get here?”

❌ “This feels disconnected.”

Logical acceleration reduces cognitive effort and increases belief.

2. Emotional Compounding

Emotions should build gradually, not in spikes.

Strong pitches layer emotions like this:

curiosity

interest

tension

clarity

insight

relief

inevitability

Weak pitches jump randomly:

confusion → interest → confusion → excitement → confusion

Confusion kills momentum instantly.

3. Consistent Narrative Energy

Momentum requires a rhythm.

Think of your pitch like a conversation with perfectly controlled energy:

no rambling

no long explanations

no unnecessary detail

no sudden tangents

no contradictions

The more consistent the energy → the more momentum builds.

4. Escalating Insight

Momentum increases when each new concept is:

clearer

stronger

more insightful

more valuable

If your strongest point is at the beginning → the pitch collapses.

If your strongest point is at the end → the pitch succeeds.

Narrative momentum is basically insight escalation.

⭐ Where Momentum Breaks (Common Founder Mistakes)

These mistakes instantly kill narrative momentum:

❌ Introducing too much detail too early

❌ Breaking the logical chain

❌ Overusing jargon

❌ Adding an off-topic slide

❌ Introducing complexity without analogy

❌ Dropping emotional connection

❌ Abrupt energy changes

❌ Weak transitions

Momentum breaks → conviction breaks.

Conviction breaks → the deal breaks.

⭐ Why Narrative Momentum Works So Well

Because humans perceive stories relationally.

When the brain detects rising clarity + rising logic + rising inevitability, it shortcut-jumps to:

“This is a winner.”

Momentum produces:

✔ belief

✔ clarity

✔ confidence

✔ trust

✔ excitement

✔ inevitability

Momentum is not speed — it’s directional coherence.

When your pitch moves with purpose, investors lean in.

When your pitch wobbles, investors lean out.

⭐ The Rule

Narrative momentum is the psychological engine that turns curiosity into conviction.

If every slide strengthens the next one, the investor will finish the pitch already believing.

This is how top founders win meetings — and win rounds.

If you want to see how slide sequencing creates narrative momentum step-by-step, the Slide Structure & Frameworks guide breaks down the universal patterns top founders use to keep their story accelerating instead of losing energy.

SECTION 14 — The “Investor Mirror Effect”:

How to Make Investors See Their Own Logic Reflected in Your Story (The Ultimate Persuasion Hack)**

There is no more powerful psychological force in fundraising than this:

People believe what they think are their own ideas.

If an investor feels like YOU convinced them → they resist.

If an investor feels like THEY arrived at the conclusion on their own → they commit.

This is the Investor Mirror Effect — the art of shaping your narrative so the investor sees their own thinking reflected in your story.

The result?

✔ zero resistance

✔ fast belief formation

✔ rapid conviction

✔ effortless buy-in

✔ natural alignment

This is persuasion without pressure.

⭐ Why the Investor Mirror Effect Works

Mirroring works because the human brain is designed to:

✔ prefer its own thoughts

✔ validate its own conclusions

✔ trust internally-generated ideas

✔ avoid cognitive dissonance

✔ reward patterns it recognizes

When an investor believes YOU made the point → they evaluate it.

When they believe THEY discovered the point → they trust it.

This is the psychological shift that wins deals.

⭐ How to Create the Investor Mirror Effect (Without Manipulation)

There are four ways to do this naturally inside a pitch.

1. Leave Space for Investor Inference

Instead of over-explaining:

❌ “This is why our product is the only solution.”

❌ “This is proof we’ll dominate the market.”

Use inference triggers:

✔ “Here’s what we discovered.”

✔ “Here’s how the workflow behaves.”

✔ “Here’s what happened when teams tried X.”

This gives the investor mental room to conclude:

“Ah… that means this product is inevitable.”

They think it.

They believe it more.

2. Use Pattern Cues Investors Already Recognize

VCs think in pattern recognition:

huge market

urgent pain

structural insight

timing shift

distribution edge

repeatable GTM

When your narrative aligns with these patterns, the investor thinks:

“This fits the model.”

And because it fits THEIR model,

they feel ownership over the insight.

3. Use the Psychologically Perfect Slide Order

Mirroring works only when the narrative flows like a VC thought process.

Example:

Problem → Insight → Solution → Timing → Market → GTM → Traction → Business Model → Team

This is exactly how investors think.

4. Let Investors “Finish the Sentence” Themselves

Great founders pause at the perfect moments.

Examples of natural mirror triggers:

✔ “…and this is where most teams break.”

(Investor thinks: “Yes, that’s true.”)

✔ “…here’s the shift that changes everything.”

(Investor thinks: “I think I know where this is going.”)

✔ “…which leads to the real bottleneck.”

(Investor thinks: “Exactly — the bottleneck is X.”)

The moment the investor “fills in” the thought,

the belief becomes theirs, not yours.

⭐ The Mirror Effect Works Because It Reduces Resistance

Push a belief too hard → investor resists.

Let them arrive at the belief → investor accepts.

This reduces:

friction

skepticism

uncertainty

ego defense

cognitive strain

All of these weaken fundraising.

Mirroring eliminates all five simultaneously.

⭐ The Rule

If the investor thinks they discovered the insight, they will defend it, advocate for it, and fund it.

Your job is not to force belief.

Your job is to engineer the moment belief appears in their mind.

That is the Investor Mirror Effect.

SECTION 15 — The “Cognitive Ease Principle”:

Why Investors Say Yes to Startups That Feel Easy to Understand (Even If They’re Complex Inside)

Investors don’t invest in the best startup.

They invest in the startup that feels the easiest to understand.

This is the Cognitive Ease Principle — one of the strongest psychological drivers behind investor decision-making.

Here’s how the brain works:

What is easy to understand feels more true.

What feels more true feels less risky.

What feels less risky gets funded.

Cognitive ease (low mental friction) = high perceived certainty.

Cognitive strain (complexity, jargon, unclear logic) = high perceived risk.

This principle is so powerful it can override:

✔ better traction

✔ better product

✔ better technology

✔ better revenue

✔ better team

Because the investor’s brain trusts clarity, not complexity.

⭐ Why Cognitive Ease Dominates Early-Stage Investing

Early-stage investing is mostly about:

belief

instinct

perceived founder quality

anticipated execution

the story making sense

When a startup’s narrative feels easy to process, the investor’s brain assumes:

✔ “This founder thinks clearly.”

✔ “This model is simple enough to scale.”

✔ “I can explain this to my partners.”

✔ “This is low-friction to understand → low-friction to fund.”

Ease = confidence.

Ease = trust.

Ease = momentum.

And cognitive ease is what produces this.

⭐ The 4 Cognitive Ease Levers You Must Use in Your Pitch

These are the psychological levers top founders use to win investors fast.

1. Simplicity of Language

The simpler the language → the smarter the founder appears.

Because simple language signals:

✔ conceptual mastery

✔ clarity of thought

✔ executive intelligence

✔ operational focus

This is the opposite of what new founders think.

Bad founders:

❌ “We leverage distributed systems to optimize… blah blah…”

Great founders:

✔ “We make billing run itself.”

Cognitive ease begins with word choice.

2. Clean Narrative Sequencing

If your pitch follows the investor’s mental model, the brain relaxes.

Problem → Insight → Solution → Why Now → Product → Market → Competition → GTM → Traction → Business Model → Team → Ask

When the narrative matches the brain’s prediction pattern, investors think:

“This makes sense.”

The moment they think that → you win.

3. Low-Friction Slides

Slides should feel like:

✔ clean

✔ minimal

✔ well-structured

✔ intuitive

✔ visually consistent

High visual friction = low cognitive ease.

Every cluttered slide reduces belief.

Every clean slide increases safety.

This is why your entire deck kit works so well — it enforces high cognitive ease by design.

4. Insight Density (Not Information Density)

Most founders output too much information.

Top founders output just enough insight.

Information overload → mental fatigue → rejection.

Insight clarity → mental ease → belief.

Examples:

❌ Information:

“We do 14 things, integrate 22 APIs, and automate 7 processes.”

✔ Insight:

“We eliminate the part of the workflow that breaks everything.”

Less information = more comprehension.

More comprehension = more belief.

⭐ Why Cognitive Ease Beats the Competition

Even if a competing startup is objectively better,

if their pitch takes more mental effort to understand,

you win.

This is why:

clear founders beat smart founders

simple decks beat complex decks

well-sequenced narratives beat overloaded ones

inevitability beats information

Cognitive ease is the great equalizer.

It can turn an early-stage founder into the most investable option in the entire pipeline — even without perfect traction.

⭐ The Rule

If your pitch feels effortless, investors assume your execution will feel effortless too.

Cognitive ease doesn’t make your startup simple.

It makes your startup believable.

And believable startups get funded.

📘 In-depth Guides: STORYTELLING & NARRATIVE ENGINEERING

Below are deeper, judgment-focused breakdowns

SUB-PILLAR 1: Foundations of Storytelling in Pitch Decks

SUB-PILLAR 2: Crafting a Strong Narrative

SUB-PILLAR 3: Storytelling Frameworks Used by Top Startups

SUB-PILLAR 4: Creating Emotional Engagement

SUB-PILLAR 5: Messaging That Builds Trust

SUB-PILLAR 6: Storytelling Across All Slides

SUB-PILLAR 7: Visual Storytelling & Deck Design Messaging

SUB-PILLAR 8: Advanced Storytelling Techniques

SUB-PILLAR 9: Storytelling Mistakes & Red Flags

Frequently Asked Questions (For Pillar 5: Storytelling & Narrative Control)

1. What is the #1 thing investors look for in a startup story?

Emotional clarity.

Investors want to feel the founder fully understands the problem, user, and market with calm precision. Narrative clarity signals execution ability.

2. How long should my startup story be inside a pitch deck?

Your story should compress into 2–3 sentences and expand only when asked. Narrative compression is a sign of founder intelligence.

3. Should I use personal stories in my pitch?

Yes — selectively.

A single human story builds emotional resonance, but avoid drama or oversharing. Keep it relevant and insight-driven, not sentimental.

4. What makes a startup story memorable to VCs?

Aha insights + inevitability language.

Investors remember the ideas that feel uniquely true and the shifts that make your product feel unavoidable.

5. How emotional should a startup story be?

Use controlled emotion.

Emotion should clarify the insight, not distract from it.

6. Does storytelling outperform traction?

At early stage, YES.

At later stage, NO.

Strong narrative fills the gap when metrics are early or incomplete.

7. What is narrative momentum and why does it matter?

It’s the sense your story gets stronger as you go.

Narrative momentum keeps investors engaged and builds conviction slide-by-slide.

8. What storytelling mistake kills fundraising the fastest?

Over-explanation.

Long stories destroy clarity and make the founder seem unprepared or inexperienced.

9. Should I tell the story of how I started the company?

Only if it contains an insight or shows inevitability.

Origin without insight = noise.

Origin with insight = credibility.

10. How do I make my narrative feel “investor-aligned”?

Follow the exact sequence investors think in:

Problem → Insight → Solution → Timing → Market → GTM → Traction → Model → Ask.

11. Should I use analogies in my pitch?

Yes, when appropriate.

Analogies reduce cognitive load and increase understanding — a key part of Cognitive Ease.

12. What if my idea is complicated?

Then your story must be simple.

The more complex the startup, the simpler the narrative must be.

13. Can good storytelling overcome weak design?

Yes — but only at early stage.

At later stages, both design and narrative must be strong.

14. How does the Funding Blueprint help with storytelling?

It gives you structured, investor-aligned narrative templates that remove friction, increase clarity, and match VC cognition patterns (ADD LINK HERE).

15. How do I know if my story is strong enough?

Use this test:

❓ Can a stranger repeat your pitch in 8 seconds?

If yes, you have narrative clarity.

If no, you have narrative friction.

16. Should my narrative change depending on the investor?

Slightly — yes.

Different investors prioritize different parts of the story (market, team, traction, etc.).

But the core narrative remains consistent.

17. How can I make my story sound more authoritative?

Use domain language, insights, specificity, and structured sequencing. Avoid hype words or generalities.

18. Do top-tier VCs care more about the narrative or the numbers?

They care about alignment between the two.

Your narrative should frame the numbers, making them feel logical and inevitable.

If you want to apply all 15 psychological principles without overthinking:

gives you the exact narrative structure that matches investor cognition:

low cognitive load

high clarity

strong emotional anchors

narrative compression

authority signaling

inevitability sequencing

It’s the same system used by 650+ founders who’ve collectively raised $40M+ — without hiring a $5K pitch deck consultant.

If you’re serious about building a pitch investors remember, believe, and fund,

the Blueprint gives you everything you need.

You can continue learning with the rest of the Pitch Deck Authority Series:

Pillar 1 — How VC Pitch Decks Really Work

Pillar 2 — Problem & Solution Slides

Pillar 3 — Slide Structure & Frameworks

Pillar 4 — Investor Psychology

Pillar 5 — Storytelling & Narrative (this page)

Pillar 6 — Design Principles

Pillar 7 — Traction & Metrics

Pillar 8 — Market Size & Competition

Pillar 9 — Fundraising Strategy

Pillar 10 — Pitch Delivery

Pillar 11 — Mistakes, Red Flags & Investor Judgment

Pillar 12 — Tools, Templates & Examples

Funding Blueprint

© 2025 Funding Blueprint. All Rights Reserved.